Dollar General 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

• The equity awards granted in March 2016 include a ‘‘double-trigger’’ provision which

requires a termination event within a certain period of time following a change in control

in order for vesting to accelerate in connection with the change in control.

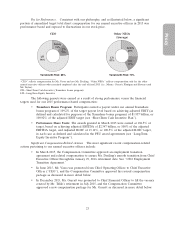

Shareholder Response. The most recent shareholder advisory vote on our named executive

officer compensation was held in 2014, based on the three-year frequency approved by our shareholders

in 2011. Excluding abstentions and broker non-votes, 96.0% of total votes were cast in support of the

program. Because we viewed this outcome as overwhelmingly supportive of our compensation policies

and practices, we did not believe the vote required consideration of changes to the program. The next

shareholder advisory vote on our named executive officer compensation will be held at our 2017 annual

meeting of shareholders.

Philosophy and Objectives

We strive to attract, retain and motivate persons with superior ability, to reward outstanding

performance, and to align the long-term interests of our named executive officers with those of our

shareholders. The material compensation principles applicable to the compensation of our named

executive officers are outlined below:

• In determining total compensation, we consider the reasonable range of the median of

comparable positions at companies within our market comparator group, but we make

adjustments based on circumstances, such as unique job descriptions and responsibilities as

well as our particular niche in the retail sector, that are not reflected in the market data.

For competitive or other reasons, our levels of total compensation or any component of

compensation may exceed or be below the median range of our market comparator group.

• We set base salaries to reflect the responsibilities, experience, performance and

contributions of the named executive officers and the salaries for comparable benchmarked

positions, while maintaining an appropriate balance between base salary and incentive

compensation.

• We reward named executive officers who enhance our performance by linking cash and

equity incentives to the achievement of our financial goals.

• We promote share ownership to align the interests of our named executive officers with

those of our shareholders.

• In approving compensation arrangements, we consider recent compensation history,

including special or unusual compensation payments.

We have employment agreements with the named executive officers to promote executive

continuity, aid in retention and secure valuable protections for Dollar General, such as non-compete,

non-solicitation and confidentiality obligations.

Oversight and Process

Oversight. The Compensation Committee of our Board of Directors, consisting entirely of

independent directors, determines and approves the compensation of our named executive officers.

Beginning in 2016, such determination pertaining to the level of CEO compensation will be subject to

ratification by the independent members of the Board.

Use of Outside Advisors. The Compensation Committee has selected Meridian Compensation

Partners (‘‘Meridian’’) to serve as its compensation consultant and has determined that Meridian is

independent and that its work has not raised any conflicts of interest. Meridian (or its predecessor) has

served as the Committee’s consultant since 2007 and was re-selected in 2014 after the Committee

conducted an extensive review and request for proposal process. A Meridian representative attends

24