Dollar General 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

statements and is anticipating a material impact because the Company is party to a significant number

of lease contracts.

Reclassifications

Certain financial disclosures relating to prior periods have been reclassified to conform to the

current year presentation where applicable.

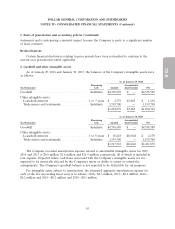

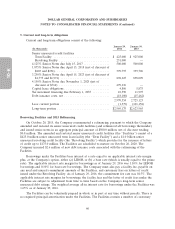

2. Goodwill and other intangible assets

As of January 29, 2016 and January 30, 2015, the balances of the Company’s intangible assets were

as follows:

As of January 29, 2016

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill .............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests ..................... 1 to 7 years $ 4,379 $3,085 $ 1,294

Trade names and trademarks .............. Indefinite 1,199,700 — 1,199,700

$1,204,079 $3,085 $1,200,994

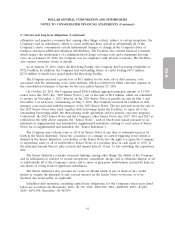

As of January 30, 2015

Remaining Accumulated

(In thousands) Life Amount Amortization Net

Goodwill .............................. Indefinite $4,338,589 $ — $4,338,589

Other intangible assets:

Leasehold interests ..................... 1 to 8 years $ 18,218 $16,048 $ 2,170

Trade names and trademarks .............. Indefinite 1,199,700 — 1,199,700

$1,217,918 $16,048 $1,201,870

The Company recorded amortization expense related to amortizable intangible assets for 2015,

2014 and 2013 of $0.9 million, $5.8 million and $11.9 million, respectively, all of which is included in

rent expense. Expected future cash flows associated with the Company’s intangible assets are not

expected to be materially affected by the Company’s intent or ability to renew or extend the

arrangements. The Company’s goodwill balance is not expected to be deductible for tax purposes.

For intangible assets subject to amortization, the estimated aggregate amortization expense for

each of the five succeeding fiscal years is as follows: 2016—$0.3 million, 2017—$0.2 million, 2018—

$0.2 million and 2019—$0.2 million and 2020—$0.1 million.

55