Dollar General 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

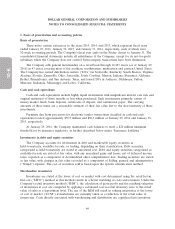

1. Basis of presentation and accounting policies (Continued)

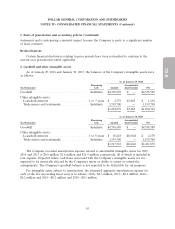

The excess of current cost over LIFO cost was approximately $92.9 million and $95.1 million at

January 29, 2016 and January 30, 2015, respectively. Current cost is determined using the RIM on a

first-in, first-out basis. Under the LIFO inventory method, the impacts of rising or falling market price

changes increase or decrease cost of sales (the LIFO provision or benefit). The Company recorded a

LIFO provision (benefit) of $(2.3) million in 2015, $4.2 million in 2014, and $(11.0) million in 2013,

which is included in cost of goods sold in the consolidated statements of income.

The Company purchases its merchandise from a wide variety of suppliers. The Company’s largest

and second largest suppliers each accounted for approximately 7% of the Company’s purchases in 2015.

Vendor rebates

The Company accounts for all cash consideration received from vendors in accordance with

applicable accounting standards pertaining to such arrangements. Cash consideration received from a

vendor is generally presumed to be a rebate or an allowance and is accounted for as a reduction of

merchandise purchase costs as earned. However, certain specific, incremental and otherwise qualifying

SG&A expenses related to the promotion or sale of vendor products may be offset by cash

consideration received from vendors, in accordance with arrangements such as cooperative advertising,

when earned for dollar amounts up to but not exceeding actual incremental costs.

Prepaid expenses and other current assets

Prepaid expenses and other current assets include prepaid amounts for rent, maintenance, business

licenses, advertising, and insurance, and amounts receivable for certain vendor rebates (primarily those

expected to be collected in cash) and coupons.

Property and equipment

In 2007, the Company’s property and equipment was recorded at estimated fair values as the result

of a merger transaction. Property and equipment acquired subsequent to the merger has been recorded

at cost. The Company records depreciation and amortization on a straight-line basis over the assets’

47