Dollar General 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168

|

|

10-K

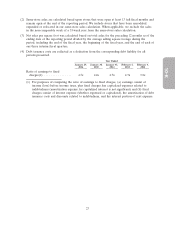

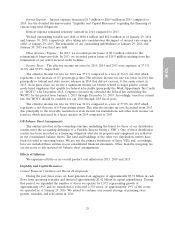

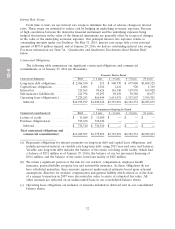

(2) Same-store sales are calculated based upon stores that were open at least 13 full fiscal months and

remain open at the end of the reporting period. We include stores that have been remodeled,

expanded or relocated in our same-store sales calculation. When applicable, we exclude the sales

in the non-comparable week of a 53-week year from the same-store sales calculation.

(3) Net sales per square foot was calculated based on total sales for the preceding 12 months as of the

ending date of the reporting period divided by the average selling square footage during the

period, including the end of the fiscal year, the beginning of the fiscal year, and the end of each of

our three interim fiscal quarters.

(4) Debt issuance costs are reflected as a deduction from the corresponding debt liability for all

periods presented.

Year Ended

January 29, January 30, January 31, February 1, February 3,

2016 2015 2014 2013 2012

Ratio of earnings to fixed

charges(1): ................ 4.5x 4.4x 4.7x 4.7x 3.8x

(1) For purposes of computing the ratio of earnings to fixed charges, (a) earnings consist of

income (loss) before income taxes, plus fixed charges less capitalized expenses related to

indebtedness (amortization expense for capitalized interest is not significant) and (b) fixed

charges consist of interest expense (whether expensed or capitalized), the amortization of debt

issuance costs and discounts related to indebtedness, and the interest portion of rent expense.

23