Dollar General 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Share-based payments

The Company accounts for share-based payments in accordance with applicable accounting

standards, under which the fair value of each award is separately estimated and amortized into

compensation expense over the service period. The fair value of the Company’s stock option grants are

estimated on the grant date using the Black-Scholes-Merton valuation model. Forfeitures are estimated

at the time of valuation and reduce expense ratably over the vesting period. The application of this

valuation model involves assumptions that are judgmental and highly sensitive in the determination of

compensation expense.

On July 6, 2007, the Company’s Board of Directors adopted the 2007 Stock Incentive Plan for Key

Employees, which plan was subsequently amended (as so amended, the ‘‘Plan’’). The Plan allows the

granting of stock options, stock appreciation rights, and other stock-based awards or dividend

equivalent rights to key employees, directors, consultants or other persons having a service relationship

with the Company, its subsidiaries and certain of its affiliates. The number of shares of Company

common stock authorized for grant under the Plan is 31,142,858. As of January 29, 2016, 18,556,241 of

such shares are available for future grants.

Since May 2011, most of the share-based awards issued by the Company have been in the form of

stock options, restricted stock, restricted stock units and performance share units. With limited

exceptions, stock options and restricted stock units granted to employees generally vest ratably on an

annual basis over four-year and three-year periods, respectively. Awards granted to board members

generally vest ratably over a one or three-year period. Performance share units generally vest ratably

over a three-year period, provided that certain minimum performance criteria are met in the year of

grant. With limited exceptions, the performance share unit and restricted stock unit awards are payable

in shares of common stock on the vesting date.

From July 2007 through May 2011, a significant majority of the Company’s share-based awards

were a combination of stock options that vest solely upon the continued employment of the recipient

(‘‘MSA Time Options’’) and options that vest upon the achievement of predetermined annual or

cumulative financial-based targets (‘‘MSA Performance Options’’) (collectively, the ‘‘MSA Options’’).

MSA Options generally vest ratably on an annual basis over a period of approximately five years, with

limited exceptions. The MSA Options are subject to various provisions set forth in a management

stockholder’s agreement (‘‘MSA’’) entered into with each option holder. The MSA Options have a

contractual term of 10 years and an exercise price equal to the fair value of the underlying common

stock on the date of grant.

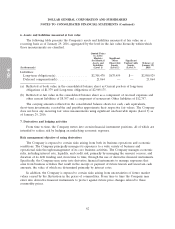

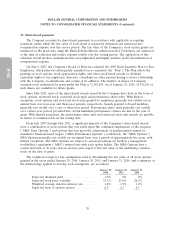

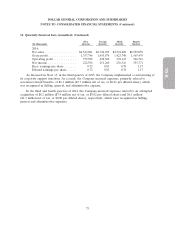

The weighted average for key assumptions used in determining the fair value of all stock options

granted in the years ended January 29, 2016, January 30, 2015, and January 31, 2014, and a summary of

the methodology applied to develop each assumption, are as follows:

January 29, January 30, January 31,

2016 2015 2014

Expected dividend yield ................... 1.2% 0% 0%

Expected stock price volatility .............. 25.3% 25.6% 26.2%

Weighted average risk-free interest rate ....... 1.8% 1.9% 1.2%

Expected term of options (years) ............ 6.4 6.3 6.3

70