Dollar General 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

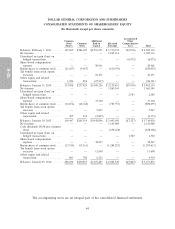

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands except per share amounts)

Accumulated

Common Additional Other

Stock Common Paid-in Retained Comprehensive

Shares Stock Capital Earnings Loss Total

Balances, February 1, 2013 ..... 327,069 $286,185 $2,991,351 $ 1,710,732 $(2,938) $ 4,985,330

Net income ................ — — — 1,025,116 — 1,025,116

Unrealized net gain (loss) on

hedged transactions ......... — — — — (6,972) (6,972)

Share-based compensation

expense ................. — — 20,961 — — 20,961

Repurchases of common stock . . . (11,037) (9,657) — (610,395) — (620,052)

Tax benefit from stock option

exercises ................ — — 24,151 — — 24,151

Other equity and related

transactions .............. 1,026 896 (27,237) — — (26,341)

Balances, January 31, 2014 ..... 317,058 $277,424 $3,009,226 $ 2,125,453 $(9,910) $ 5,402,193

Net income ................ — — — 1,065,345 — 1,065,345

Unrealized net gain (loss) on

hedged transactions ......... — — — — 2,583 2,583

Share-based compensation

expense ................. — — 37,338 — — 37,338

Repurchases of common stock . . . (14,106) (12,342) — (787,753) — (800,095)

Tax benefit from stock option

exercises ................ — — 5,047 — — 5,047

Other equity and related

transactions .............. 495 432 (2,805) — — (2,373)

Balances, January 30, 2015 ..... 303,447 $265,514 $3,048,806 $ 2,403,045 $(7,327) $ 5,710,038

Net income ................ — — — 1,165,080 — 1,165,080

Cash dividends, $0.88 per common

share ................... — — — (258,328) — (258,328)

Unrealized net gain (loss) on

hedged transactions ......... — — — — 1,520 1,520

Share-based compensation

expense ................. — — 38,547 — — 38,547

Repurchases of common stock . . . (17,556) (15,361) — (1,284,252) — (1,299,613)

Tax benefit from stock option

exercises ................ — — 13,698 — — 13,698

Other equity and related

transactions .............. 803 702 6,232 — — 6,934

Balances, January 29, 2016 ..... 286,694 $250,855 $3,107,283 $ 2,025,545 $(5,807) $ 5,377,876

The accompanying notes are an integral part of the consolidated financial statements.

44