Dollar General 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

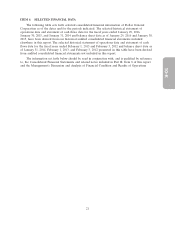

included in Part II, Item 7 of this report. Certain financial disclosures relating to prior periods have

been reclassified to conform to the current year presentation.

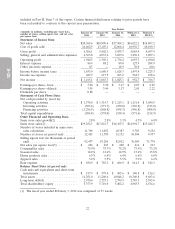

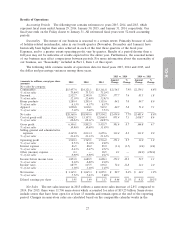

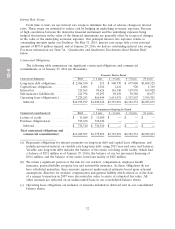

Year Ended

(Amounts in millions, excluding per share data, January 29, January 30, January 31, February 1, February 3,

number of stores, selling square feet, and net sales 2016 2015 2014 2013 2012(1)

per square foot)

Statement of Income Data:

Net sales ......................... $20,368.6 $18,909.6 $17,504.2 $16,022.1 $14,807.2

Cost of goods sold .................. 14,062.5 13,107.1 12,068.4 10,936.7 10,109.3

Gross profit ....................... 6,306.1 5,802.5 5,435.7 5,085.4 4,697.9

Selling, general and administrative expenses 4,365.8 4,033.4 3,699.6 3,430.1 3,207.1

Operating profit .................... 1,940.3 1,769.1 1,736.2 1,655.3 1,490.8

Interest expense .................... 86.9 88.2 89.0 127.9 204.9

Other (income) expense .............. 0.3 — 18.9 30.0 60.6

Income before income taxes ........... 1,853.0 1,680.9 1,628.3 1,497.4 1,225.3

Income tax expense .................. 687.9 615.5 603.2 544.7 458.6

Net income ....................... $ 1,165.1 $ 1,065.3 $ 1,025.1 $ 952.7 $ 766.7

Earnings per share—basic ............. $ 3.96 $ 3.50 $ 3.17 $ 2.87 $ 2.25

Earnings per share—diluted ............ 3.95 3.49 3.17 2.85 2.22

Dividends per share ................. 0.88 — — — —

Statement of Cash Flows Data:

Net cash provided by (used in):

Operating activities ................ $ 1,378.0 $ 1,314.7 $ 1,213.1 $ 1,131.4 $ 1,050.5

Investing activities ................. (503.4) (371.7) (250.0) (569.8) (513.8)

Financing activities ................ (1,296.5) (868.8) (598.3) (546.8) (908.0)

Total capital expenditures ............. (504.8) (374.0) (538.4) (571.6) (514.9)

Other Financial and Operating Data:

Same store sales growth(2) ............ 2.8% 2.8% 3.3% 4.7% 6.0%

Same store sales(2) .................. $19,254.3 $17,818.7 $16,365.5 $14,992.7 $13,626.7

Number of stores included in same store

sales calculation ................... 11,706 11,052 10,387 9,783 9,254

Number of stores (at period end) ........ 12,483 11,789 11,132 10,506 9,937

Selling square feet (in thousands at period

end) ........................... 92,477 87,205 82,012 76,909 71,774

Net sales per square foot(3) ........... $ 226 $ 223 $ 220 $ 216 $ 213

Consumables sales .................. 75.9% 75.7% 75.2% 73.9% 73.2%

Seasonal sales ...................... 12.4% 12.4% 12.9% 13.6% 13.8%

Home products sales ................. 6.3% 6.4% 6.4% 6.6% 6.8%

Apparel sales ...................... 5.4% 5.5% 5.5% 5.9% 6.2%

Rent expense ...................... $ 856.9 $ 785.2 $ 686.9 $ 614.3 $ 542.3

Balance Sheet Data (at period end):

Cash and cash equivalents and short-term

investments ...................... $ 157.9 $ 579.8 $ 505.6 $ 140.8 $ 126.1

Total assets ........................ 11,251.0 11,208.6 10,848.2 10,340.8 9,663.6

Long-term debt(4) .................. 2,970.6 2,725.1 2,799.5 2,745.3 2,593.6

Total shareholders’ equity ............. 5,377.9 5,710.0 5,402.2 4,985.3 4,674.6

(1) The fiscal year ended February 3, 2012 was comprised of 53 weeks.

22