Dollar General 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

Interest Rate Swaps

From time to time, we use interest rate swaps to minimize the risk of adverse changes in interest

rates. These swaps are intended to reduce risk by hedging an underlying economic exposure. Because

of high correlation between the derivative financial instrument and the underlying exposure being

hedged, fluctuations in the value of the financial instruments are generally offset by reciprocal changes

in the value of the underlying economic exposure. Our principal interest rate exposure relates to

outstanding amounts under our Facilities. On May 31, 2015, interest rate swaps with a total notional

amount of $875.0 million expired, and at January 29, 2016, we had no outstanding interest rate swaps.

For more information see Item 7A, ‘‘Quantitative and Qualitative Disclosures about Market Risk’’

below.

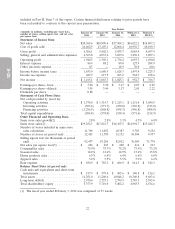

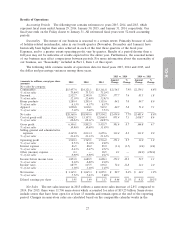

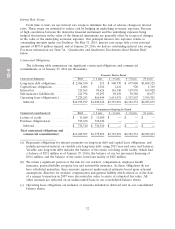

Contractual Obligations

The following table summarizes our significant contractual obligations and commercial

commitments as of January 29, 2016 (in thousands):

Payments Due by Period

Contractual obligations Total < 1 year 1 - 3 years 3 - 5 years 5+ years

Long-term debt obligations ........ $ 2,986,590 $ 215 $ 900,770 $ 677,080 $1,408,525

Capital lease obligations .......... 4,806 1,164 1,412 920 1,310

Interest(a) .................... 513,562 89,626 141,340 119,576 163,020

Self-insurance liabilities(b) ........ 221,796 83,293 89,438 30,388 18,677

Operating lease obligations(c) ...... 7,229,243 866,444 1,614,931 1,353,567 3,394,301

Subtotal .................... $10,955,997 $1,040,742 $2,747,891 $2,181,531 $4,985,833

Commitments Expiring by Period

Commercial commitments(d) Total < 1 year 1 - 3 years 3 - 5 years 5+ years

Letters of credit ................ $ 11,680 $ 11,680 $ — $ — $ —

Purchase obligations(e) .......... 722,630 722,630———

Subtotal .................... $ 734,310 $ 734,310 $ — $ — $ —

Total contractual obligations and

commercial commitments(f) ..... $11,690,307 $1,775,052 $2,747,891 $2,181,531 $4,985,833

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and

includes projected interest on variable rate long-term debt, using 2015 year end rates and balances.

Variable rate long-term debt includes the balance of the senior revolving credit facility (which had

a balance of $251 million as of January 29, 2016), the balance of our tax increment financing of

$10.6 million, and the balance of the senior term loan facility of $425 million.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health

insurance, general liability, property loss and automobile insurance. As these obligations do not

have scheduled maturities, these amounts represent undiscounted estimates based upon actuarial

assumptions. Reserves for workers’ compensation and general liability which existed as of the date

of a merger transaction in 2007 were discounted in order to arrive at estimated fair value. All

other amounts are reflected on an undiscounted basis in our consolidated balance sheets.

(c) Operating lease obligations are inclusive of amounts included in deferred rent in our consolidated

balance sheets.

32