Dollar General 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

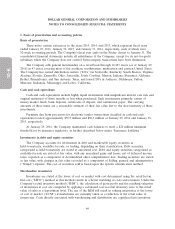

1. Basis of presentation and accounting policies (Continued)

Share-based payments

The Company recognizes compensation expense for share-based compensation based on the fair

value of the awards on the grant date. Forfeitures are estimated at the time of valuation and reduce

expense ratably over the vesting period. This estimate may be adjusted periodically based on the extent

to which actual forfeitures differ, or are expected to differ, from the prior estimate. The forfeiture rate

is the estimated percentage of share-based awards granted that are expected to be forfeited or canceled

before becoming fully vested. The Company bases this estimate on historical experience or estimates of

future trends, as applicable. An increase in the forfeiture rate will decrease compensation expense.

The fair value of each option grant is separately estimated and amortized into compensation

expense on a straight-line basis between the applicable grant date and each vesting date. The Company

has estimated the fair value of all stock option awards as of the grant date by applying the Black-

Scholes-Merton option pricing valuation model. The application of this valuation model involves

assumptions that are judgmental and highly sensitive in the determination of compensation expense.

The Company calculates compensation expense for restricted stock, share units and similar awards

as the difference between the market price of the underlying stock or similar award on the grant date

and the purchase price, if any. Such expense is recognized on a straight-line basis for graded awards or

an accelerated basis for performance awards over the period in which the recipient earns the awards.

Store pre-opening costs

Pre-opening costs related to new store openings and the related construction periods are expensed

as incurred.

Income taxes

Under the accounting standards for income taxes, the asset and liability method is used for

computing the future income tax consequences of events that have been recognized in the Company’s

consolidated financial statements or income tax returns. Deferred income tax expense or benefit is the

net change during the year in the Company’s deferred income tax assets and liabilities.

The Company includes income tax related interest and penalties as a component of the provision

for income tax expense.

Income tax reserves are determined using a methodology which requires companies to assess each

income tax position taken using a two-step process. A determination is first made as to whether it is

more likely than not that the position will be sustained, based upon the technical merits, upon

examination by the taxing authorities. If the tax position is expected to meet the more likely than not

criteria, the benefit recorded for the tax position equals the largest amount that is greater than 50%

likely to be realized upon ultimate settlement of the respective tax position. Uncertain tax positions

require determinations and estimated liabilities to be made based on provisions of the tax law which

may be subject to change or varying interpretation. If the Company’s determinations and estimates

prove to be inaccurate, the resulting adjustments could be material to the Company’s future financial

results.

53