Dollar General 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

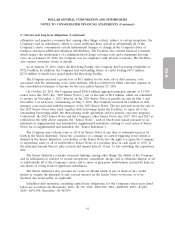

8. Commitments and contingencies (Continued)

The Company’s responsive pleadings are due in the McCormick matter on March 21, 2016; in the

Fruhling matter on April 4, 2016; in the Meyer matter on April 6, 2016; in the Sheehy matter on April 7,

2016; in the Solis matter on April 8, 2016; in the Foppe matter and Gooel matter on April 15, 2016; and

in the Harvey, Oren and Vega matters on April 22, 2016.

The Company believes that the labeling, marketing and sale of its private-label motor oil complies

with applicable federal and state requirements and is not misleading. The Company further believes

that these matters are not appropriate for class or similar treatment. The Company intends to

vigorously defend these actions; however, at this time, it is not possible to predict whether any of these

cases will be permitted to proceed as a class or the size of any putative class. Likewise, at this time, it

is not possible to estimate the value of the claims asserted, and no assurances can be given that the

Company will be successful in its defense of these actions on the merits or otherwise. For these

reasons, the Company is unable to estimate the potential loss or range of loss in these matters;

however if the Company is not successful in its defense efforts, the resolution of any of these actions

could have a material adverse effect on the Company’s consolidated financial statements as a whole.

From time to time, the Company is a party to various other legal actions involving claims

incidental to the conduct of its business, including actions by employees, consumers, suppliers,

government agencies, or others through private actions, class actions, administrative proceedings,

regulatory actions or other litigation, including without limitation under federal and state employment

laws and wage and hour laws. The Company believes, based upon information currently available, that

such other litigation and claims, both individually and in the aggregate, will be resolved without a

material adverse effect on the Company’s consolidated financial statements as a whole. However,

litigation involves an element of uncertainty. Future developments could cause these actions or claims

to have a material adverse effect on the Company’s results of operations, cash flows, or financial

position. In addition, certain of these lawsuits, if decided adversely to the Company or settled by the

Company, may result in liability material to the Company’s financial position or may negatively affect

operating results if changes to the Company’s business operation are required.

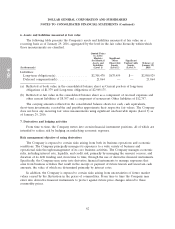

9. Benefit plans

The Dollar General Corporation 401(k) Savings and Retirement Plan, which became effective on

January 1, 1998, is a safe harbor defined contribution plan and is subject to the Employee Retirement

and Income Security Act (‘‘ERISA’’).

A participant’s right to claim a distribution of his or her account balance is dependent on the plan,

ERISA guidelines and Internal Revenue Service regulations. All active participants are fully vested in

all contributions to the 401(k) plan. During 2015, 2014 and 2013, the Company expensed approximately

$15.0 million, $13.7 million and $13.0 million, respectively, for matching contributions.

The Company also has a nonqualified supplemental retirement plan (‘‘SERP’’) and compensation

deferral plan (‘‘CDP’’), known as the Dollar General Corporation CDP/SERP Plan, for a select group

of management and other key employees. The Company incurred compensation expense for these plans

of approximately $1.1 million, $0.8 million and $1.2 million in 2015, 2014 and 2013, respectively.

The CDP/SERP Plan assets are invested in accounts selected by the Company’s Compensation

Committee or its delegate, and the associated deferred compensation liability is reflected in the

consolidated balance sheets as further discussed in Note 6.

69