Dollar General 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

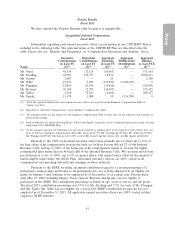

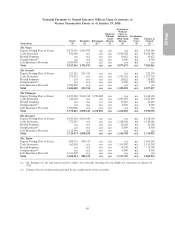

Proxy

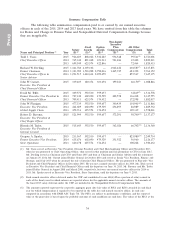

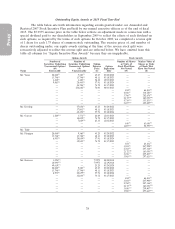

Option Awards Stock Awards

Number of Number of Number of Shares Market Value of

Securities Underlying Securities Underlying Option or Units of Shares or Units

Unexercised Options Unexercised Options Exercise Option Stock That Have of Stock That

(#) (#) Price Expiration Not Vested Have Not Vested

Name Exercisable Unexercisable ($) Date (#) ($)

Ms. Taylor 10,284

(18)

— 25.25 03/24/2020 — —

3,547

(1)

1,182

(1)

45.25 03/20/2022 — —

1,501

(2)

1,498

(2)

48.11 03/18/2023 — —

3,454

(19)

3,454

(19)

54.48 05/28/2023 — —

2,119

(4)

6,351

(4)

57.91 03/18/2024 — —

— 32,843

(5)

74.72 03/17/2025 — —

————93

(7)

6,981

(7)

— — — — 1,006

(8)

75,510

(8)

— — — — 2,762

(9)

207,316

(9)

— — — — 237

(10)

17,789

(10)

— — — — 1,052

(11)

78,963

(11)

— — — — 3,965

(12)

297,613

(12)

Mr. Sparks — — — — — —

(1) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of March 20, 2012, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon

Termination or Change in Control’’ below.

(2) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of March 18, 2013, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon

Termination or Change in Control’’ below.

(3) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of December 3, 2013, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments

upon Termination or Change in Control’’ below.

(4) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of March 18, 2014, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon

Termination or Change in Control’’ below.

(5) These options are part of a grant of time-based options with a vesting schedule of 25% per year on April 1 of 2016, 2017,

2018 and 2019, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or

Change in Control’’ below.

(6) These options are part of a grant of time-based options with a vesting schedule of 331⁄3% per year on each of the third,

fourth and fifth anniversaries of June 3, 2015, subject to certain accelerated vesting provisions as described in ‘‘Potential

Payments upon Termination or Change in Control’’ below.

(7) Represents PSUs, to be paid in an equal number of shares of our common stock, earned as a result of our performance

versus certain adjusted EBITDA and ROIC targets for fiscal 2013 and scheduled to vest on March 18, 2016, subject to

certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or Change in Control’’ below.

The market value was computed by multiplying the number of such units by the closing market price of one share of our

common stock on January 29, 2016.

(8) Represents PSUs, to be paid in an equal number of shares of our common stock, earned as a result of our performance

versus certain adjusted EBITDA and ROIC targets for fiscal 2014 and scheduled to vest 50% per year on March 18, 2016

and March 18, 2017, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination

or Change in Control’’ below. The market value was computed by multiplying the number of such units by the closing

market price of one share of our common stock on January 29, 2016.

(9) Represents PSUs, to be paid in an equal number of shares of our common stock, earned as a result of our performance

versus certain adjusted EBITDA and ROIC targets for fiscal 2015 and scheduled to vest 50% per year on April 1, 2017 and

April 1, 2018, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or

Change in Control’’ below. The market value was computed by multiplying the number of units by the closing market price

of one share of our common stock on January 29, 2016.

(10) Represents RSUs, to be paid in an equal number of shares of our common stock, which are scheduled to vest on March 18,

2016, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or Change in

Control’’ below. The market value was computed by multiplying the number of such units by the closing market price of

one share of our common stock on January 29, 2016.

(11) Represents RSUs, to be paid in an equal number of shares of our common stock, which are scheduled to vest 50% per year

on March 18, 2016 and March 18, 2017, subject to certain accelerated vesting provisions as described in ‘‘Potential

Payments upon Termination or Change in Control’’ below. The market value was computed by multiplying the number of

such units by the closing market price of one share of our common stock on January 29, 2016.

39