Dollar General 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

predict customer trends, we inappropriately price products or our expectations about customer

spending levels are inaccurate, we may have to take unanticipated markdowns to dispose of the excess

inventory, which also can adversely impact our financial results. We continue to focus on ways to

reduce these risks, but we cannot make assurances that we will be successful in our inventory

management. If we are not successful in managing our inventory balances, our cash flows from

operations may be negatively affected.

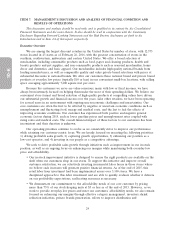

Because our business is seasonal to a certain extent, with the highest volume of net sales during the

fourth quarter, adverse events during the fourth quarter could materially affect our financial statements as a

whole.

We generally recognize our highest volume of net sales during the Christmas selling season, which

occurs in the fourth quarter of our fiscal year. In anticipation of this holiday, we purchase substantial

amounts of seasonal inventory. Adverse events, such as deteriorating economic conditions, high

unemployment, high gas prices, public transportation disruptions, or unusual or unanticipated adverse

weather could result in lower-than-planned sales during the holiday season. An excess of seasonal

merchandise inventory could result if our net sales during the Christmas selling season fall below

seasonal norms or expectations. If our fourth quarter sales results were substantially below expectations,

our financial performance and operating results could be adversely affected by unanticipated

markdowns, especially in seasonal merchandise.

Our current insurance program may expose us to unexpected costs and negatively affect our financial

performance.

Our insurance coverage reflects deductibles, self-insured retentions, limits of liability and similar

provisions that we believe are prudent based on the dispersion of our operations. However, there are

types of losses we may incur but against which we cannot be insured or which we believe are not

economically reasonable to insure, such as losses due to acts of war, employee and certain other crime,

certain wage and hour and other employment-related claims, including class actions, and some natural

disasters. If we incur these losses and they are material, our business could suffer. Certain material

events may result in sizable losses for the insurance industry and adversely impact the availability of

adequate insurance coverage or result in excessive premium increases. To offset negative insurance

market trends, we may elect to self-insure, accept higher deductibles or reduce the amount of coverage

in response to these market changes. In addition, we self-insure a significant portion of expected losses

under our workers’ compensation, automobile liability, general liability and group health insurance

programs. Unanticipated changes in any applicable actuarial assumptions and management estimates

underlying our recorded liabilities for these losses, including expected increases in medical and

indemnity costs, could result in materially different expenses than expected under these programs,

which could have a material adverse effect on our results of operations and financial condition.

Although we continue to maintain property insurance for catastrophic events at our store support

center and distribution centers, we are effectively self-insured for other property losses. If we

experience a greater number of these losses than we anticipate, our financial performance could be

adversely affected.

Any failure to maintain the security of information we hold relating to our customers, employees and

vendors, whether as a result of cybersecurity attacks or otherwise, could expose us to litigation, government

enforcement actions and costly response measures, and could materially disrupt our operations and harm our

reputation and sales.

In connection with sales, we transmit confidential credit and debit card information. We also have

access to, collect or maintain certain private or confidential information regarding our customers,

employees and vendors, as well as our business. Additionally, under certain circumstances, we may

14