Dollar General 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

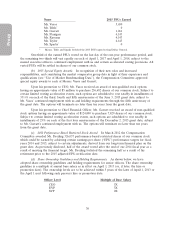

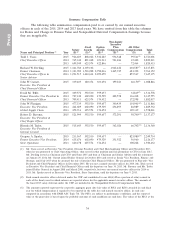

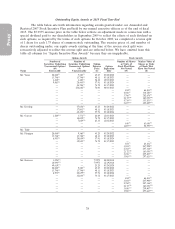

grant date assuming that the highest level of performance conditions will be achieved are as follows for each fiscal year

required to be reported for each applicable named executive officer:

Fiscal Mr. Vasos Mr. Dreiling Mr. Garratt Mr. Tehle Mr. Flanigan Mr. Ravener Ms. Taylor Mr. Sparks

Year ($) ($) ($) ($) ($) ($) ($) ($)

2015 1,212,033 N/A 270,561 888,794 888,794 888,794 888,794 888,794

2014 1,234,699 5,268,189 N/A 905,481 905,481 N/A N/A 905,481

2013 623,987 3,431,879 N/A 623,987 623,987 N/A N/A 623,987

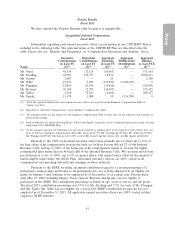

Information regarding the assumptions made in the valuation of these awards is set forth in Note 10 of the annual

consolidated financial statements in our 2015 Form 10-K.

(4) The amounts reported represent the respective aggregate grant date fair value of stock options awarded to the applicable

named executive officer in the fiscal year indicated, computed in accordance with FASB ASC Topic 718. Information

regarding assumptions made in the valuation of these awards is set forth in Note 10 of the annual consolidated financial

statements in our 2015 Form 10-K.

(5) Represents amounts earned pursuant to our Teamshare bonus program for each fiscal year reported. See the discussion of

the ‘‘Short-Term Cash Incentive Plan’’ and ‘‘CEO Employment Transition Agreement’’ in ‘‘Compensation Discussion and

Analysis’’ above. None of the named executive officers deferred any portion of the Teamshare bonus payments reported

above under the CDP.

(6) Includes $32,115 and $14,167, respectively, for our match contributions to the CDP and the 401(k) Plan; $1,306 for

premiums paid under our life insurance program; and $51,953 which represents the aggregate incremental cost of providing

certain perquisites, including $21,470 for personal security services for a limited duration, $19,514 for financial and estate

planning services, $5,000 for the reimbursement of legal expenses incurred in connection with the negotiation of his

employment agreement and other amounts for perquisites which individually did not equal or exceed the greater of $25,000

or 10% of total perquisites, including premiums paid under our group long-term disability program, costs associated with

attendance by him and his guests at sporting events, miscellaneous gifts, nominal incremental costs incurred for a guest to

accompany him on business and an administrative fee for coverage under our short-term disability program, as well as

participation in a group umbrella liability insurance program offered at no incremental cost to Dollar General through a

third party vendor at a group rate paid by the executive and coverage under our business travel accident insurance for

which Dollar General incurs no incremental cost for participation by the named executive officers in addition to certain

other employees.

(7) Includes $268,303 for our contribution to the SERP and $54,675 and $13,690, respectively, for our match contributions to

the CDP and the 401(k) Plan; $1,692 for premiums paid under our life insurance program; $143,456 for cash dividends

accumulated on shares of unvested restricted stock that were ultimately forfeited with the shares of unvested restricted

stock upon Mr. Dreiling’s retirement; and $122,771 which represents the aggregate incremental cost of providing certain

perquisites, including $79,539 for costs associated with personal airplane usage, $19,437 for costs associated with financial

and estate planning services, $12,118 for a retirement gift, $8,417 for premiums paid under a personal portable long-term

disability policy, and other amounts for perquisites which individually did not equal or exceed the greater of $25,000 or

10% of total perquisites, including premiums paid under our group long-term disability program, costs associated with

attendance by him and his guests at sporting events, miscellaneous gifts and an administrative fee for coverage under our

short-term disability program, as well as participation in a group umbrella liability insurance program which is offered at no

incremental cost to Dollar General through a third party vendor at a group rate paid by the executive and coverage under

our business travel accident insurance for which Dollar General incurs no incremental cost for participation by the named

executive officers in addition to certain other employees. The aggregate incremental cost related to the personal airplane

usage was calculated using costs we would not have incurred but for the personal usage (including costs incurred as a result

of ‘‘deadhead’’ legs of personal flights), including fuel costs, variable maintenance costs, crew expenses, landing, parking and

other associated fees, supplies and catering costs.

(8) Includes $1,979 for our match contributions to the 401(k) Plan; $7,080 for tax gross-ups related to relocation; $478 for

premiums paid under our life insurance program; and $56,613 which represents the aggregate incremental cost of providing

certain perquisites, including $53,672 for costs associated with relocation and other amounts for perquisites which

individually did not equal or exceed the greater of $25,000 or 10% of total perquisites, including premiums paid under our

group long-term disability program, costs associated with attendance by him and his guests at sporting events, miscellaneous

gifts and an administrative fee for coverage under our short-term disability program, as well as coverage under our business

travel accident insurance for which Dollar General incurs no incremental cost for participation by the named executive

officers in addition to certain other employees. The aggregate incremental cost related to relocation included expenses

associated with physical movement of his household goods and costs incurred in connection with the sale of his former

home (such as appraisals, inspections, pre-title expenses, title and deed costs, broker’s commission, document preparation

fees, recording fees and legal fees) and the purchase of his new home (including a one percent origination fee).

35