Dollar General 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

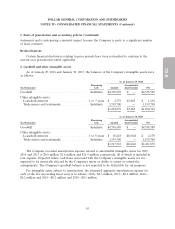

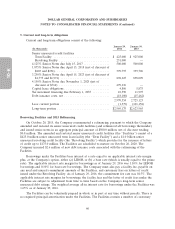

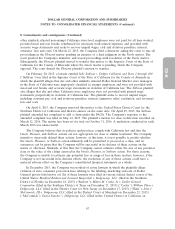

5. Current and long-term obligations

Current and long-term obligations consist of the following:

January 29, January 30,

(In thousands) 2016 2015

Senior unsecured credit facilities

Term Facility ................................ $ 425,000 $ 925,000

Revolving Facility ............................. 251,000 —

4.125% Senior Notes due July 15, 2017 ............... 500,000 500,000

1.875% Senior Notes due April 15, 2018 (net of discount of

$203 and $294) ............................... 399,797 399,706

3.250% Senior Notes due April 15, 2023 (net of discount of

$1,775 and $1,991) ............................ 898,225 898,009

4.150% Senior Notes due November 1, 2025 (net of

discount of $764) ............................. 499,236 —

Capital lease obligations .......................... 4,806 5,875

Tax increment financing due February 1, 2035 .......... 10,590 11,995

Debt issuance costs, net .......................... (18,100) (15,462)

2,970,554 2,725,123

Less: current portion ............................ (1,379) (101,158)

Long-term portion .............................. $2,969,175 $2,623,965

Borrowing Facilities and 2015 Refinancing

On October 20, 2015, the Company consummated a refinancing, pursuant to which the Company

amended and restated its senior unsecured credit facilities (and refinanced all borrowings thereunder)

and issued senior notes in an aggregate principal amount of $500.0 million, net of discount totaling

$0.8 million. The amended and restated senior unsecured credit facilities (the ‘‘Facilities’’) consist of a

$425.0 million senior unsecured term loan facility (the ‘‘Term Facility’’) and a $1.0 billion senior

unsecured revolving credit facility (the ‘‘Revolving Facility’’) which provides for the issuance of letters

of credit up to $175.0 million. The Facilities are scheduled to mature on October 20, 2020. The

Company incurred $2.6 million of new debt issuance costs associated with the refinancing of the

Facilities.

Borrowings under the Facilities bear interest at a rate equal to an applicable interest rate margin

plus, at the Company’s option, either (a) LIBOR or (b) a base rate (which is usually equal to the prime

rate). The applicable interest rate margin for borrowings as of January 29, 2016 was 1.10% for LIBOR

borrowings and 0.10% for base-rate borrowings. The Company must also pay a facility fee, payable on

any used and unused commitment amounts of the Facilities, and customary fees on letters of credit

issued under the Revolving Facility. As of January 29, 2016, the commitment fee rate was 0.15%. The

applicable interest rate margins for borrowings, the facility fees and the letter of credit fees under the

Facilities are subject to adjustment from time to time based on the Company’s long-term senior

unsecured debt ratings. The weighted average all-in interest rate for borrowings under the Facilities was

1.65% as of January 29, 2016.

The Facilities can be voluntarily prepaid in whole or in part at any time without penalty. There is

no required principal amortization under the Facilities. The Facilities contain a number of customary

60