Dollar General 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Common stock transactions (Continued)

under the Company’s debt agreements and other factors. Repurchases under the program may be

funded from available cash or borrowings under the Facilities discussed in further detail in Note 5.

During the years ended January 29, 2016, January 30, 2015, and January 31, 2014, the Company

repurchased approximately 17.6 million shares of its common stock at a total cost of $1.3 billion,

approximately 14.1 million shares at a total cost of $0.8 billion and approximately 11.0 million shares of

its common stock at a total cost of $0.6 billion, respectively, pursuant to its common stock repurchase

programs.

The Company paid quarterly cash dividends of $0.22 per share during each of the four quarters of

2015. On March 8, 2016, the Company’s Board of Directors approved a quarterly cash dividend of

$0.25 per share, which is payable on April 12, 2016 to shareholders of record as of March 29, 2016.

The declaration of future cash dividends is subject to the discretion of the Company’s Board of

Directors and will depend upon, among other things, the Company’s results of operations, cash

requirements, financial condition, contractual restrictions and other factors that the Board may deem

relevant in its sole discretion.

13. Corporate restructuring

On October 13, 2015, the Company implemented a restructuring of its corporate support functions,

including the elimination of approximately 255 positions, substantially all of which were at the

Company’s corporate headquarters and effective immediately. The restructuring is part of a broader

initiative aimed at improving efficiencies and reducing expenses.

The Company incurred pretax expense of $6.1 million associated with this restructuring for

severance-related benefits. This expense is reflected in Selling, general, and administrative expenses on

the Company’s consolidated statements of income for the year ended January 29, 2016. As of

January 29, 2016, the remaining liability related to these charges is $3.5 million.

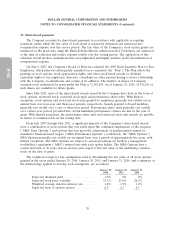

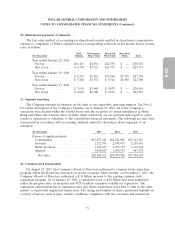

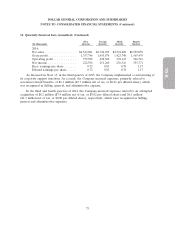

14. Quarterly financial data (unaudited)

The following is selected unaudited quarterly financial data for the fiscal years ended January 29,

2016 and January 30, 2015. Each quarterly period listed below was a 13-week accounting period. The

sum of the four quarters for any given year may not equal annual totals due to rounding.

First Second Third Fourth

(In thousands) Quarter Quarter Quarter Quarter

2015:

Net sales .................. $4,918,672 $5,095,904 $5,067,048 $5,286,938

Gross profit ................ 1,498,705 1,588,155 1,536,962 1,682,269

Operating profit ............. 428,194 475,812 423,859 612,429

Net income ................ 253,235 282,349 253,321 376,175

Basic earnings per share ....... 0.84 0.95 0.87 1.30

Diluted earnings per share ..... 0.84 0.95 0.86 1.30

74