Dollar General 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

change in control, all unvested PSUs that have not previously been forfeited will

immediately be deemed earned at the target level and shall vest, become nonforfeitable

and be paid upon the change in control.

• If the change in control occurs after completion of the applicable performance period, and

the named executive officer has remained continuously employed until the change in

control, all previously earned but unvested PSUs that have not previously been forfeited

will immediately vest, become nonforfeitable and be paid upon the change in control.

• All outstanding RSUs will become vested and nonforfeitable and will be paid upon the

change in control.

• All CDP/SERP Plan benefits will become fully vested (to the extent not already vested).

Upon an involuntary termination without cause or a resignation for good reason following the

change in control, a named executive officer will receive the same severance payments and benefits as

described above under ‘‘Voluntary Termination with Good Reason or After Failure to Renew the

Employment Agreement.’’ However, a named executive officer will have one year from the termination

date in which to exercise vested options that were granted after 2011 if he or she resigns or is

involuntarily terminated within two years of the change in control under any scenario other than

retirement or involuntary termination with cause (in which respective cases, he or she will have five

years from the retirement date to exercise vested options and will forfeit any vested but unexercised

options held at the time of the termination with cause).

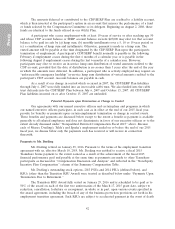

In the event of a change in control as defined in Section 280G of the Internal Revenue Code,

each named executive officer’s employment agreement provides for capped payments (taking into

consideration all payments and benefits covered by Section 280G of the Internal Revenue Code) of $1

less than the amount that would trigger the ‘‘golden parachute’’ excise tax under federal income tax

rules (the ‘‘excise tax’’) unless he or she signs a release and the after-tax benefit would be at least

$50,000 more than it would be without the payments being capped. In such case, such officer’s

payments and benefits would not be capped and such officer would be responsible for the payment of

the excise tax. We would not pay any additional amount to cover the excise tax.

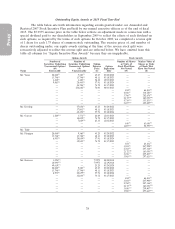

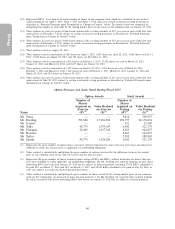

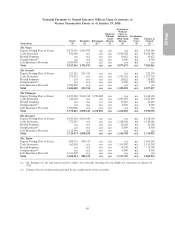

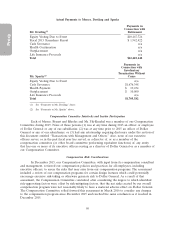

Except for Messrs. Dreiling and Sparks, for whom a separate table is provided below to reflect

actual payments based upon their respective termination scenarios, and Mr. Tehle, who is not included

in the table because he received no such payments as a result of his service termination, the following

table reflects potential payments to each named executive officer in various termination and change in

control scenarios based on compensation, benefit, and equity levels in effect on, and assuming the

scenario was effective as of, January 29, 2016. For stock valuations, we have used the closing price of

our stock on the NYSE on January 29, 2016 ($75.06). The tables below report only amounts that are

increased, accelerated or otherwise paid or owed as a result of the applicable scenario and, as a result,

exclude earned but unpaid base salary through the employment termination date and equity awards and

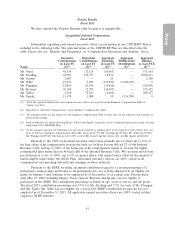

CDP/SERP Plan benefits that had vested prior to the event. For more information regarding the CDP/

SERP Plan benefits, see ‘‘Nonqualified Deferred Compensation Fiscal 2015’’ above. The tables also

exclude any amounts that are available generally to all salaried employees and do not discriminate in

favor of our executive officers. Other than with respect to Messrs. Dreiling and Sparks, the amounts

shown are merely estimates. We cannot determine actual amounts to be paid until a termination or

change in control scenario occurs.

48