Dollar General 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

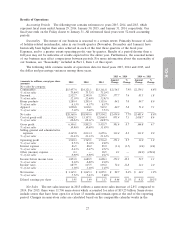

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

This discussion and analysis should be read with, and is qualified in its entirety by, the Consolidated

Financial Statements and the notes thereto. It also should be read in conjunction with the Cautionary

Disclosure Regarding Forward-Looking Statements and the Risk Factors disclosures set forth in the

Introduction and in Item 1A of this report, respectively.

Executive Overview

We are among the largest discount retailers in the United States by number of stores, with 12,575

stores located in 43 states as of February 26, 2016, with the greatest concentration of stores in the

southern, southwestern, midwestern and eastern United States. We offer a broad selection of

merchandise, including consumable products such as food, paper and cleaning products, health and

beauty products and pet supplies, and non-consumable products such as seasonal merchandise, home

decor and domestics, and basic apparel. Our merchandise includes high-quality national brands from

leading manufacturers, as well as comparable quality and value private brand selections with prices at

substantial discounts to national brands. We offer our customers these national brand and private brand

products at everyday low prices (typically $10 or less) in our convenient small-box locations, with selling

space averaging approximately 7,400 square feet per store.

Because the customers we serve are value-conscious, many with low or fixed incomes, we have

always been intensely focused on helping them make the most of their spending dollars. We believe our

convenient store format and broad selection of high-quality products at compelling values have driven

our substantial growth and financial success over the years. Like other retailers, we have been operating

for several years in an environment with ongoing macroeconomic challenges and uncertainties. Our

core customers are often the first to be affected by negative or uncertain economic conditions such as

unemployment and fluctuating food, energy and medical costs, and the last to feel the effects of

improving economic conditions. Our customer has experienced both positive and negative general

economic factors during 2015, such as lower gasoline prices and unemployment rates coupled with

rising rents and medical costs. The overall financial impact of these factors to our customers has been

inconsistent and their duration is unknown.

Our operating priorities continue to evolve as we consistently strive to improve our performance

while retaining our customer-centric focus. We are keenly focused on executing the following priorities:

1) driving profitable sales growth, 2) capturing growth opportunities, 3) enhancing our position as a

low-cost operator, and 4) investing in our people as a competitive advantage.

We seek to drive profitable sales growth through initiatives such as improvement in our in-stock

position, as well as an ongoing focus on enhancing our margins while maintaining both everyday low

price and affordability.

• Our in-stock improvement initiative is designed to ensure the right products are available on the

shelf when our customers shop in our stores. To support this initiative and improve overall

customer satisfaction, we are selectively investing incremental labor hours in those stores where

we believe such increases will generate positive financial returns. As of the end of 2015, this

retail labor hour investment had been implemented across over 3,100 stores. We have a

disciplined approach to this labor investment and are able to quickly evaluate whether it delivers

on our profitability expectations, reallocating resources as necessary.

• We demonstrate our commitment to the affordability needs of our core customer by pricing

more than 75% of our stock-keeping units at $5 or less as of the end of 2015. However, as we

work to provide everyday low prices and meet our customers’ affordability needs, we also remain

focused on enhancing our margins through effective category management, inventory shrink

reduction initiatives, private brands penetration, efforts to improve distribution and

24