Dollar General 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

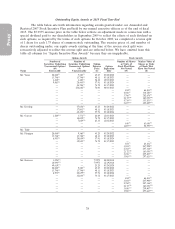

The amounts deferred or contributed to the CDP/SERP Plan are credited to a liability account,

which is then invested at the participant’s option in an account that mirrors the performance of a fund

or funds selected by the Compensation Committee or its delegate. Beginning on August 2, 2008, these

funds are identical to the funds offered in our 401(k) Plan.

A participant who ceases employment with at least 10 years of service or after reaching age 50

and whose CDP account balance or SERP account balance exceeds $25,000 may elect for that account

balance to be paid in cash by (a) lump sum, (b) monthly installments over a 5, 10 or 15-year period or

(c) a combination of lump sum and installments. Otherwise, payment is made in a lump sum. The

vested amount will be payable at the time designated by the CDP/SERP Plan upon the participant’s

termination of employment. A participant’s CDP/SERP benefit normally is payable in the following

February if employment ceases during the first 6 months of a calendar year or is payable in the

following August if employment ceases during the last 6 months of a calendar year. However,

participants may elect to receive an in-service lump sum distribution of vested amounts credited to the

CDP account, provided that the date of distribution is no sooner than 5 years after the end of the year

in which the amounts were deferred. In addition, a participant who is actively employed may request an

‘‘unforeseeable emergency hardship’’ in-service lump sum distribution of vested amounts credited to the

participant’s CDP account. Account balances are payable in cash.

As a result of our change in control which occurred in 2007, the CDP/SERP Plan liabilities

through July 6, 2007 were fully funded into an irrevocable rabbi trust. We also funded into the rabbi

trust deferrals into the CDP/SERP Plan between July 6, 2007 and October 15, 2007. All CDP/SERP

Plan liabilities incurred on or after October 15, 2007 are unfunded.

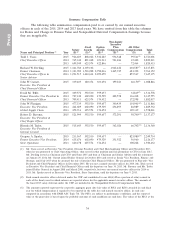

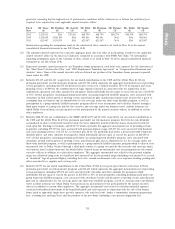

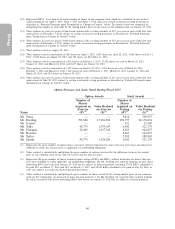

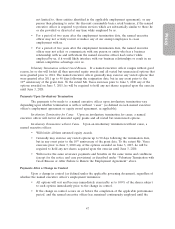

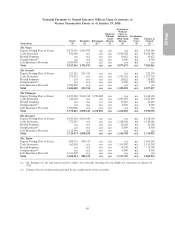

Potential Payments upon Termination or Change in Control

Our agreements with our named executive officers and certain plans and programs in which

our named executive officers participate, in each case as in effect at the end of our 2015 fiscal year,

provide for benefits or payments upon certain employment termination or change in control events.

These benefits and payments are discussed below except to the extent a benefit or payment is available

generally to all salaried employees and does not discriminate in favor of our executive officers or to the

extent already discussed under ‘‘Nonqualified Deferred Compensation Fiscal 2015’’ above. Because

each of Messrs. Dreiling’s, Tehle’s and Sparks’s employment ended on or before the end of our 2015

fiscal year, we discuss below only the payments each has received or will receive in connection

therewith.

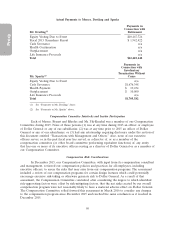

Payments to Mr. Dreiling

Mr. Dreiling retired on January 29, 2016. Pursuant to the terms of his employment transition

agreement with us, effective March 10, 2015, Mr. Dreiling was entitled to receive a fiscal 2015

Teamshare bonus payment to the extent earned as a result of the achievement of the fiscal 2015

financial performance goal and payable at the same time as payments are made to other Teamshare

participants as discussed in ‘‘Compensation Discussion and Analysis’’ and reflected in the ‘‘Non-Equity

Incentive Plan Compensation’’ column of the Summary Compensation Table.

Mr. Dreiling’s outstanding stock options, 2013 PSUs and 2014 PSUs (defined below), and

RSUs (other than the Transition RSU Award) were treated as described below under ‘‘Payments Upon

Termination Due to Retirement.’’

The Transition RSU Award fully vested on January 29, 2016 and is scheduled to be paid as to

50% of the award on each of the first two anniversaries of the March 17, 2015 grant date, subject to

reduction, cancellation, forfeiture or recoupment, in whole or in part, upon various events specified in

the award agreement, including the breach of any of the business protection provisions set forth in his

employment transition agreement. Such RSUs are subject to accelerated payment in the event of death

42