Dollar General 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

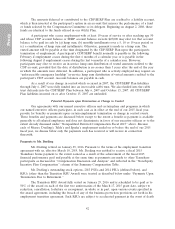

or disability (in which event payment will be made within 90 days following such event) or a change in

control (in which event the payment will be made upon the change in control), in each case prior to an

originally scheduled payment date. Disability and change in control are defined in the equity award

agreement.

Finally, upon his retirement Mr. Dreiling forfeited the unvested portion of the performance-

based restricted stock awarded to him in 2012.

Mr. Dreiling is subject to various business protection provisions substantially as described for

the other named executive officers below under ‘‘Payments Upon Voluntary Termination—Voluntary

Termination with Good Reason or After Failure to Renew the Employment Agreement.’’

Payments to Mr. Tehle

Mr. Tehle’s service termination date was June 30, 2015, and his departure was treated as a

voluntary termination without good reason under all applicable plans and agreements. His outstanding

equity awards were treated as described below under ‘‘Payments Upon Voluntary Termination—

Voluntary Termination without Good Reason.’’

Payments to Mr. Sparks

Mr. Sparks’ service termination date was June 9, 2015. He received or will receive severance

payments and benefits, and his outstanding equity awards were treated, as described under ‘‘Payments

Upon Involuntary Termination—Involuntary Termination without Cause.’’

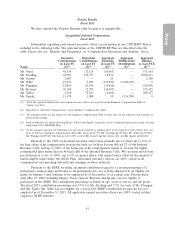

Payments Upon Termination Due to Death or Disability

Pre-2012 Equity Awards. Mr. Ravener and Ms. Taylor have options outstanding that were

granted prior to 2012. All such options are fully vested and generally may be exercised for a period of

one year from termination of employment due to death or disability (as defined in the applicable award

agreement) unless such options have expired earlier.

Post-2011 Equity Awards. If a named executive officer’s employment with us terminates due to

death or disability (as defined in the applicable award agreement):

• Stock Options. Any outstanding unvested stock option shall become immediately vested

and exercisable with respect to 100% of the shares subject to the option immediately prior

to such event, and such vested options may be exercised until the first anniversary of the

employment termination date.

• Performance Share Units. PSUs were awarded in fiscal 2013 (‘‘2013 PSUs’’), fiscal 2014

(‘‘2014 PSUs’’) and, except for Mr. Dreiling, fiscal 2015 (‘‘2015 PSUs’’) to each named

executive who was employed by us at the time of the applicable award.

✓If such termination had occurred before January 29, 2016 for the 2015 PSUs, a

pro-rated portion (based on months employed during the one year performance

period) of one-third of the 2015 PSUs earned based on performance during the

entire performance period would have become vested and nonforfeitable (unless

previously vested or forfeited) as of January 29, 2016 and would have been paid

on April 1, 2016. If such termination had occurred on or after January 29, 2016

for the 2015 PSUs and before April 1, 2016, the participant would have received

the one-third of the 2015 PSUs earned that are described above, without

proration.

✓If such termination occurs after March 18, 2014 for the 2013 PSUs, March 18,

2015 for the 2014 PSUs or April 1, 2016 for the 2015 PSUs, any remaining earned

43