Dollar General 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. Derivatives and hedging activities (Continued)

Cash flow hedges of interest rate risk

The Company’s objectives when using interest rate derivatives are to add stability to interest

expense and to manage its exposure to interest rate changes. To accomplish these objectives, the

Company has from time to time used interest rate swaps as part of its interest rate risk management

strategy. Interest rate swaps designated as cash flow hedges involve the receipt of variable-rate amounts

from a counterparty in exchange for the Company making fixed-rate payments over the life of the

agreements without exchange of the underlying notional amount. The Company also previously entered

into treasury locks that were designated as cash flow hedges of interest rate risk prior to the issuance

of long-term debt in April 2013.

The effective portion of changes in the fair value of derivatives designated and that qualify as cash

flow hedges is recorded in Accumulated other comprehensive income (loss) (also referred to as ‘‘OCI’’)

and is subsequently reclassified into earnings in the period that the hedged forecasted transaction

affects earnings. The ineffective portion of the change in fair value of the interest rate swaps, if any, is

recognized directly in earnings.

The Company had interest rate swaps with a combined notional value of $875.0 million designated

as cash flow hedges of interest rate risk that expired on May 31, 2015. Such interest rate swaps were

used to hedge the variable cash flows associated with existing variable-rate debt prior to their maturity.

Amounts reported in Accumulated other comprehensive income (loss) related to derivatives were

reclassified to interest expense as interest payments were made on the Company’s variable-rate debt.

In April 2013, the Company recorded a loss on the settlement of treasury locks associated with the

issuance of long-term debt which was deferred to OCI and is being amortized as an increase to interest

expense over the period of the debt’s maturity in 2023. During the 52-week period following

January 29, 2016, the Company estimates that approximately $1.3 million will be reclassified as an

increase to interest expense related to the amortization of the loss associated with the treasury locks.

All of the amounts reflected in Accumulated other comprehensive income (loss) in the consolidated

balance sheets for the periods presented are related to cash flow hedges.

Non-designated hedges of commodity risk

Derivatives not designated as hedges are not speculative and are used to manage the Company’s

exposure to commodity price risk but do not meet strict hedge accounting requirements. Changes in

the fair value of derivatives not designated in hedging relationships are recorded directly in earnings.

As of January 29, 2016, the Company had no such non-designated hedges.

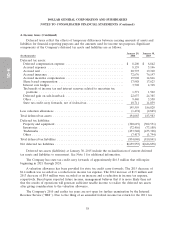

The table below presents the fair value of the Company’s derivative financial instruments as well as

their classification on the consolidated balance sheets as of January 29, 2016 and January 30, 2015:

January 29, January 30,

(in thousands) 2016 2015

Derivatives Designated as Hedging Instruments

Interest rate swaps classified as Accrued expenses and

other current liabilities ......................... $— $1,173

63