Dollar General 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4. Income taxes (Continued)

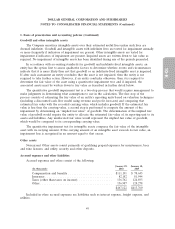

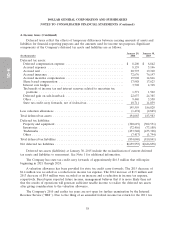

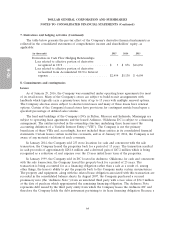

Deferred taxes reflect the effects of temporary differences between carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities are as follows:

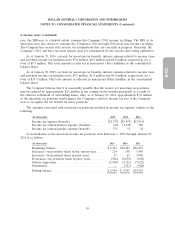

January 29, January 30,

(In thousands) 2016 2015

Deferred tax assets:

Deferred compensation expense ................................. $ 8,200 $ 8,842

Accrued expenses ........................................... 8,139 5,146

Accrued rent ............................................... 20,793 19,360

Accrued insurance ........................................... 72,676 76,197

Accrued incentive compensation ................................. 19,902 14,866

Share based compensation ..................................... 17,988 17,623

Interest rate hedges .......................................... 3,702 4,318

Tax benefit of income tax and interest reserves related to uncertain tax

positions ................................................ 1,371 1,502

Deferred gain on sale-leaseback ................................. 22,637 24,385

Other .................................................... 9,440 3,550

State tax credit carry forwards, net of federal tax ..................... 10,711 11,039

195,559 186,828

Less valuation allowances ....................................... (1,474) (2,845)

Total deferred tax assets ........................................ 194,085 183,983

Deferred tax liabilities:

Property and equipment ....................................... (320,619) (302,531)

Inventories ................................................ (72,456) (73,188)

Trademarks ................................................ (433,548) (433,328)

Other .................................................... (7,417) (1,794)

Total deferred tax liabilities ...................................... (834,040) (810,841)

Net deferred tax liabilities ....................................... $(639,955) $(626,858)

Deferred tax assets (liabilities) at January 30, 2015 include the reclassification of current deferred

tax assets and liabilities to noncurrent. See Note 1 for additional information.

The Company has state tax credit carry forwards of approximately $16.5 million that will expire

beginning in 2021 through 2024.

A valuation allowance has been provided for state tax credit carry forwards. The 2015 decrease of

$1.4 million was recorded as a reduction in income tax expense. The 2014 increase of $1.5 million and

2013 decrease of $0.4 million were recorded as an increase and a reduction in income tax expense,

respectively. Based upon expected future income, management believes that it is more likely than not

that the results of operations will generate sufficient taxable income to realize the deferred tax assets

after giving consideration to the valuation allowance.

The Company’s 2010 and earlier tax years are not open for further examination by the Internal

Revenue Service (‘‘IRS’’). Due to the filing of an amended federal income tax return for the 2011 tax

58