Dollar General 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

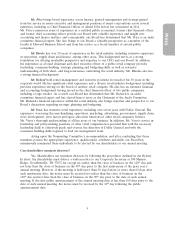

We do not compensate for Board service any director who also serves as our employee. We will

reimburse directors for certain fees and expenses incurred in connection with continuing education

seminars and for travel and related expenses related to Dollar General business.

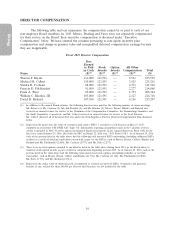

Each non-employee director will receive payment (prorated as applicable) for a fiscal year in

quarterly installments of the following cash compensation, as applicable, along with an annual award of

RSUs, payable in shares of our common stock, under our Amended and Restated 2007 Stock Incentive

Plan having the following estimated value:

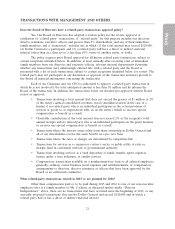

Per Meeting

Fee for

Audit Compensation Nominating Meetings Estimated

Lead Committee Committee Committee Attended in Value of

Board Director Chairman Chairman Chairman Excess of 16 Equity

Fiscal Retainer Retainer Retainer Retainer Retainer During FY Award

Year ($) ($) ($) ($) ($) ($) ($)

2015 85,000 25,000 22,500 20,000 15,000 1,500 125,000

2016 85,000 N/A(1) 22,500 20,000 15,000 1,500 135,000

(1) Because the Chairman of the Board is an independent director, we do not intend to re-appoint a lead director in fiscal

2016. In lieu of an additional cash retainer for this service, the Chairman of the Board will receive an annual Chairman

retainer delivered in the form of RSUs, payable in shares of our common stock under our Amended and Restated 2007

Stock Incentive Plan and scheduled to vest on the first anniversary of the grant date, subject to certain accelerated vesting

conditions, having an estimated value of $200,000.

The RSUs are awarded annually to those non-employee directors who are elected or re-elected

at the shareholders’ meeting and to any new director appointed after the annual shareholders’ meeting

but before February 1 of a given year. Beginning with the 2015 award, the RSUs are scheduled to vest

on the first anniversary of the grant date subject to full acceleration of vesting upon death, disability (as

defined in the applicable award agreement) or voluntary departure from the Board. Directors may elect

to defer receipt of shares underlying the RSUs.

These fees and equity award values and the mix of equity, including the changes in director

compensation identified below, were recommended each year by the Compensation Committee, and

approved by the Board, after taking into account market benchmarking data, Meridian’s

recommendations, the input of the CEO and the Chief People Officer (with respect to 2015 and prior

years) and, for the additional equity award to the Chairman in 2016, the amount of time anticipated to

be devoted to the mentoring of a new CEO. Although the Committee may solicit and consider the

input of our CEO and our Chief People Officer, it and the Board retain and exercise ultimate decision-

making authority regarding director compensation.

As a result of such considerations, (1) as previously disclosed, the equity mix was changed

beginning in 2015 to deliver all of the equity value in RSUs as opposed to the 2014 equity mix which

consisted of 60% stock options and 40% RSUs; and (2) the estimated value of the equity award was

increased beginning in fiscal 2016.

Up to 100% of cash fees earned for Board services in a fiscal year may be deferred under the

Non-Employee Director Deferred Compensation Plan. Benefits are payable upon separation from

service in the form, as elected by the director at the time of deferral, of a lump sum distribution or

monthly payments for 5, 10 or 15 years. Participating directors can direct the hypothetical investment of

deferred fees into funds identical to those offered in our 401(k) Plan and will be credited with the

deemed investment gains and losses. The amounts deferred, along with deemed investment gains and

losses, are credited to a liability account. The amount of the benefit will vary depending on the fees the

director has deferred and the deemed investment gains and losses. Benefits upon death are payable to

the director’s named beneficiary. In the event of a director’s disability (as defined in the Non-Employee

17