Dollar General 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

(12) Represents RSUs, to be paid in an equal number of shares of our common stock, which are scheduled to vest in three

equal installments on April 1, 2016, April 1, 2017 and April 1, 2018, subject to certain accelerated vesting provisions as

described in ‘‘Potential Payments upon Termination or Change in Control’’ below. The market value was computed by

multiplying the number of such units by the closing market price of one share of our common stock on January 29, 2016.

(13) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of December 3, 2014, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments

upon Termination or Change in Control’’ below.

(14) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of December 2, 2015, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments

upon Termination or Change in Control’’ below.

(15) These options vested on August 25, 2013.

(16) These options vested in increments of 208 shares on April 3, 2013; 1,029 shares on April 22, 2013; 4,680 shares on July 11,

2013; 11,428 shares on August 25, 2013; and 749 shares on December 11, 2013.

(17) These options vested in increments of 6,516 shares on February 1, 2013; 13,422 shares on each of March 24, 2013,

January 31, 2014 and March 24, 2014; and 2,237 shares on January 30, 2015.

(18) These options vested in increments of 1,072 shares on January 28, 2011; 1,286 shares on each of March 24, 2011,

February 3, 2012 and March 24, 2012; 1,285 shares on each of February 1, 2013, March 24, 2013, January 31, 2014 and

March 24, 2014; and 214 shares on January 30, 2015.

(19) These options are part of a grant of time-based options with a vesting schedule of 25% per year on each of the first four

anniversaries of May 28, 2013, subject to certain accelerated vesting provisions as described in ‘‘Potential Payments upon

Termination or Change in Control’’ below.

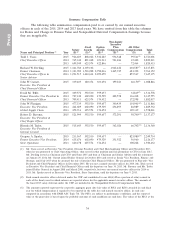

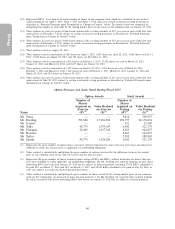

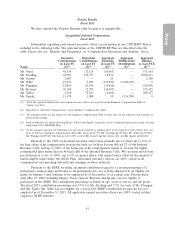

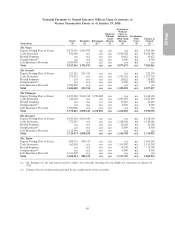

Option Exercises and Stock Vested During Fiscal 2015

Option Awards Stock Awards

Number of Number of

Shares Shares

Acquired on Value Realized Acquired on Value Realized

Exercise on Exercise Vesting on Vesting

Name (#)(1) ($)(2) (#)(3) ($)(4)

Mr. Vasos — — 9,414 709,937

Mr. Dreiling 398,880 13,206,896 296,797 21,638,854

Mr. Garratt — — 421 31,600

Mr. Tehle 48,779 1,399,187 6,902 521,179

Mr. Flanigan 28,449 1,437,362 8,283 624,837

Mr. Ravener — — 8,283 624,837

Ms. Taylor — — 2,509 188,803

Mr. Sparks 48,779 1,426,209 6,902 521,179

(1) Represents the gross number of option shares exercised, without deduction for shares that may have been surrendered or

withheld to satisfy the exercise price or applicable tax withholding obligations.

(2) Value realized is calculated by multiplying the gross number of options exercised by the difference between the market

price of our common stock on the date of exercise and the exercise price.

(3) Represents the gross number of shares acquired upon vesting of PSUs and RSUs, without deduction for shares that may

have been withheld to satisfy applicable tax withholding obligations. For Mr. Dreiling, the reported amounts include shares

underlying RSUs that vested on January 29, 2016 but are subject to delayed payment, including 57,670 RSUs scheduled to

be paid 50% on March 17, 2016 and 50% on March 17, 2017, and 22,005 RSUs scheduled to be paid on July 30, 2016, in

each case subject to certain accelerated payment provisions.

(4) Value realized is calculated by multiplying the gross number of shares vested by the closing market price of our common

stock on the vesting date. As discussed in more detail in footnote 3, for Mr. Dreiling, the reported value realized includes

the value associated with shares underlying RSUs that vested on January 29, 2016 but are subject to delayed payment.

40