Dollar General 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

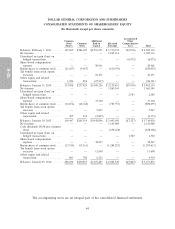

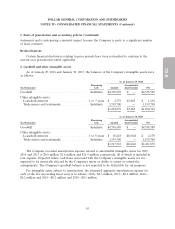

estimated useful lives. The Company’s property and equipment balances and depreciable lives are

summarized as follows:

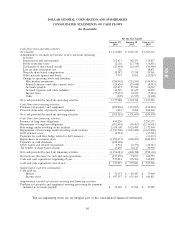

Depreciable January 29, January 30,

(In thousands) Life 2016 2015

Land ............................................ Indefinite $ 188,532 $ 172,329

Land improvements ................................. 20 66,955 55,375

Buildings ......................................... 39 - 40 834,884 800,346

Leasehold improvements .............................. (a) 402,997 361,557

Furniture, fixtures and equipment ....................... 3 - 10 2,526,843 2,295,590

Construction in progress .............................. 150,275 68,360

4,170,486 3,753,557

Less accumulated depreciation and amortization ............. 1,906,424 1,637,482

Net property and equipment ........................... $2,264,062 $2,116,075

(a) Amortized over the lesser of the life of the applicable lease term or the estimated useful life of the

asset.

Depreciation expense related to property and equipment was approximately $350.6 million,

$335.9 million and $315.3 million for 2015, 2014 and 2013. Amortization of capital lease assets is

included in depreciation expense. Interest on borrowed funds during the construction of property and

equipment is capitalized where applicable. Interest costs of $1.4 million, $0.2 million and $1.2 million

were capitalized in 2015, 2014 and 2013.

Impairment of long-lived assets

When indicators of impairment are present, the Company evaluates the carrying value of long-lived

assets, other than goodwill and other indefinite-lived intangible assets, in relation to the operating

performance and future cash flows or the appraised values of the underlying assets. Generally, the

Company’s policy is to review for impairment stores open more than three years for which current cash

flows from operations are negative. Impairment results when the carrying value of the assets exceeds

the undiscounted future cash flows expected to be generated by the assets. The Company’s estimate of

undiscounted future cash flows is based upon historical operations of the stores and estimates of future

store profitability which encompasses many factors that are subject to variability and difficult to predict.

If a long-lived asset is found to be impaired, the amount recognized for impairment is equal to the

difference between the carrying value and the asset’s estimated fair value. The fair value is estimated

based primarily upon estimated future cash flows over the asset’s remaining useful life (discounted at

the Company’s credit adjusted risk-free rate) or other reasonable estimates of fair market value. Assets

to be disposed of are adjusted to the fair value less the cost to sell if less than the book value.

The Company recorded impairment charges included in SG&A expense of approximately

$5.9 million in 2015, $1.9 million in 2014 and $0.5 million in 2013, to reduce the carrying value of

certain of its stores’ assets. Such action was deemed necessary based on the Company’s evaluation that

such amounts would not be recoverable primarily due to insufficient sales or excessive costs resulting in

the carrying value of the assets exceeding the estimated undiscounted future cash flows generated by

the assets at these locations.

48