Dollar General 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

aligned with the equity mix among our market comparator group and balanced the incentive and

retention goals of these awards.

The options are granted with a per share exercise price equal to the fair market value of one

share of our common stock on the grant date. The options vest 25% annually on the April 1 of each of

the four fiscal years following the fiscal year in which the grant is made, subject to the named executive

officer’s continued employment with us and certain accelerated vesting provisions. The RSUs are

payable in shares of our common stock and vest 331⁄3% over three years on the April 1 of the three

fiscal years following the fiscal year in which the grant is made, subject to continued employment with

us and certain accelerated vesting conditions. The PSUs can be earned if specified performance goals

are achieved during the performance period (which was fiscal year 2015) and if certain additional

vesting requirements are met.

For PSUs the Committee selects and sets targets for financial performance measures, then

establishes threshold and maximum levels of performance derived from those targets. The number of

PSUs earned depends on the level of financial performance achieved versus the goals. The Committee

selected adjusted EBITDA (weighted 50%) and ROIC (weighted 50%) as the 2015 financial

performance measures for the PSUs at target levels equal to those used in our 2015 financial plan.

These financial measures and weightings have been used for the PSUs since 2013 to appropriately

balance the emphasis placed upon earnings performance as well as rigorous capital management over

the long-term.

The adjusted EBITDA performance target is computed as income (loss) from continuing

operations before cumulative effect of change in accounting principles plus interest and other financing

costs, net, provision for income taxes, and depreciation and amortization, but excludes the impact of all

items excluded from the 2015 Teamshare program adjusted EBIT calculation outlined above, as well as

share-based compensation charges. The ROIC performance target is calculated as (a) the result of

(x) the sum of (i) our operating income, plus (ii) depreciation and amortization, plus (iii) minimum

rentals, minus (y) taxes, divided by (b) the result of (x) the sum of the averages of: (i) total assets, plus

(ii) accumulated depreciation and amortization, minus (y) (i) cash, minus (ii) goodwill, minus

(iii) accounts payable, minus (iv) other payables, minus (v) accrued liabilities, plus (vi) 8x minimum

rentals but excludes the impact of all items excluded from the 2015 Teamshare program adjusted EBIT

calculation outlined above.

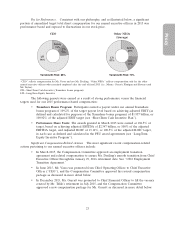

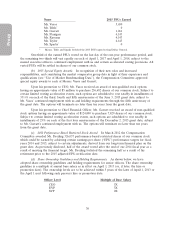

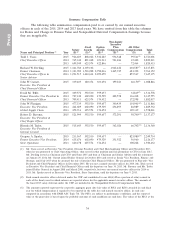

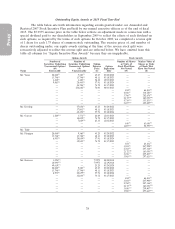

The following table shows how the PSUs would be earned at each of the threshold, target and

maximum performance levels. PSUs earned for financial performance between these levels are

interpolated in a manner similar to that used for our 2015 Teamshare bonus program, and the number

of PSUs earned could vary between 0% and 300% of the target award. The following tables also show

the actual results of the 2015 financial performance measures and the actual number of PSUs earned.

Adjusted EBITDA ROIC

Result EBITDA Units Result ROIC Units Total Units

v. Target Result ($) Earned v. Target Result Earned Earned

Level (%) (in millions) (% of Target) (%) (%) (% of Target) (% of Target)

Below Threshold <90 <2,112 0 <94.75 <18.05 0 0

Threshold 90 2,112 25 94.75 18.05 25 50

Target 100 2,347 50 100.00 19.05 50 100

Maximum 120 2,817 150 110.50 21.05 150 300

2015 Results 100 2,347 50.0 100.5 19.14 54.5 104.5

29