Dollar General 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

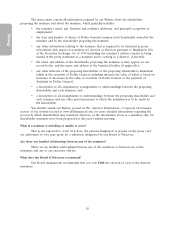

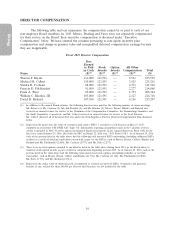

DIRECTOR COMPENSATION

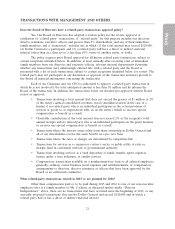

The following table and text summarize the compensation earned by or paid to each of our

non-employee Board members for 2015. Messrs. Dreiling and Vasos were not separately compensated

for their service on the Board; their executive compensation is discussed under ‘‘Executive

Compensation’’ below. We have omitted the columns pertaining to non-equity incentive plan

compensation and change in pension value and nonqualified deferred compensation earnings because

they are inapplicable.

Fiscal 2015 Director Compensation

Fees

Earned

or Paid Stock Option All Other

in Cash Awards Awards Compensation Total

Name ($)(1) ($)(2) ($)(3) ($)(4) ($)

Warren F. Bryant 111,000 121,591 — 2,961 235,552

Michael M. Calbert 110,000 121,591 — 3,625 235,216

Sandra B. Cochran 88,000 121,591 — 2,371 211,962

Patricia D. Fili-Krushel 91,000 121,591 — 2,277 214,868

Paula A. Price 85,000 121,591 — 1,753 208,344

William C. Rhodes, III 103,000 121,591 — 2,127 226,718

David B. Rickard 107,500 121,591 — 4,116 233,207

(1) In addition to the annual Board retainer, the following directors were paid for the following number of excess meetings:

Mr. Bryant (4); Ms. Cochran (2); Ms. Fili-Krushel (4); and Mr. Rhodes (2). Messrs. Bryant, Rhodes and Rickard also

received an annual retainer for service as the Chairman of the Compensation Committee, the Nominating Committee and

the Audit Committee, respectively, and Mr. Calbert received an annual retainer for service as the Lead Director.

Mr. Calbert deferred all of his fiscal 2015 fees under the Non-Employee Director Deferred Compensation Plan discussed

below.

(2) Represents the grant date fair value of restricted stock units (‘‘RSUs’’) awarded to each director on May 27, 2015,

computed in accordance with FASB ASC Topic 718. Information regarding assumptions made in the valuation of these

awards is included in Note 10 of the annual consolidated financial statements in our Annual Report on Form 10-K for the

fiscal year ended January 29, 2016, filed with the SEC on March 22, 2016 (our ‘‘2015 Form 10-K’’). As of January 29, 2016,

each of the persons listed in the table above had the following total unvested RSUs outstanding (including additional RSUs

credited as a result of dividend equivalents earned with respect to the RSUs): each of Messrs. Bryant, Calbert, Rhodes and

Rickard and Ms. Fili-Krushel (2,609); Ms. Cochran (2,977); and Ms. Price (2,277).

(3) There were no stock options awarded to any director listed in the table above during fiscal 2015, as the Board chose to

eliminate stock option awards as part of director compensation beginning in fiscal 2015. As of January 29, 2016, each of the

persons listed in the table above had the following total unexercised stock options outstanding (whether or not then

exercisable): each of Messrs. Bryant, Calbert and Rhodes (21,756); Ms. Cochran (13,120); Ms. Fili-Krushel (12,892);

Ms. Price (4,795); and Mr. Rickard (21,513).

(4) Represents the dollar value of dividends paid, accumulated or credited on unvested RSUs. Perquisites and personal

benefits, if any, totaled less than $10,000 per director and therefore are not included in the table.

16