Dollar General 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

PROPOSAL 3:

ADVISORY VOTE ON THE FREQUENCY OF HOLDING FUTURE ADVISORY

VOTES ON EXECUTIVE COMPENSATION

As required by SEC rules, we are seeking your input with regard to the frequency of future

shareholder advisory votes on our named executive officer compensation, specifically whether they

should occur once every 1, 2 or 3 years. We ask that you support a frequency period of every 3 years.

Our Board believes that a 3-year period for holding this vote:

• aligns more closely with our belief that an effective executive compensation program should

incentivize performance over both the short- and long-term. For example, some of our

performance-based awards are tied directly to significant long-term EBITDA-based growth

over a sustained period;

• provides us with sufficient time to thoughtfully consider the results of the vote and to engage

with shareholders to understand the vote results;

• allows adequate time to implement any desired changes to our compensation policies and

procedures that our Compensation Committee deems advisable; and

• provides our shareholders sufficient time to evaluate the effectiveness of our executive

compensation program, any changes made to the program, and our related performance.

Our Board believes that anything less than a 3-year frequency period will yield a short-term

mindset, detract from our long-term interests and goals, would not allow for changes to our executive

compensation program to be in place long enough to evaluate whether the changes were effective.

Although the vote we are asking you to cast is non-binding, our Board and the Compensation

Committee value the views of our shareholders and will consider the outcome of the vote when

determining the frequency of future say-on-pay votes. Furthermore, our Board welcomes input from

shareholders with respect to our executive compensation program even in years when the advisory vote

does not occur.

Our Board recommends that you vote to conduct a non-binding, advisory vote on named

executive officer compensation once every 3 YEARS.

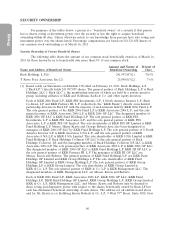

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

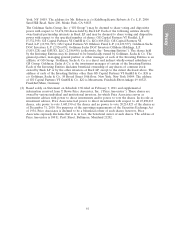

The United States securities laws require our executive officers, directors, and greater than

10% shareholders to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the

SEC. Based solely upon a review of these reports furnished to us during and with respect to 2010, or

written representations that no Form 5 reports were required, we believe that each of those persons

filed, on a timely basis, the reports required by Section 16(a) of the Securities Exchange Act of 1934,

except that (1) Mr. John Flanigan filed 1 late Form 4 to report a purchase of Dollar General common

stock directly from the Company and filed an amended Form 3 to report a holding inadvertently

omitted from his original Form 3; (2) Mr. Todd Vasos filed 1 late Form 4 to report the acquisition of a

stock option to purchase shares of Dollar General common stock resulting from the accelerated vesting

in connection with a secondary offering of shares of our common stock by certain of our shareholders

in December 2010; and (3) each of Mr. Adrian Jones and Goldman, Sachs & Co. filed 1 late Form 4 to

report 1 open market sale of Dollar General common stock by Goldman, Sachs & Co. Both Mr. Jones

and Goldman, Sachs & Co. disclaim beneficial ownership of the shares involved in the transaction.

59