Dollar General 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

Vendor rebates

The Company accounts for all cash consideration received from vendors in accordance with

applicable accounting standards pertaining to such arrangements. Cash consideration received from a

vendor is generally presumed to be a rebate or an allowance and is accounted for as a reduction of

merchandise purchase costs as earned. However, certain specific, incremental and otherwise qualifying

SG&A expenses related to the promotion or sale of vendor products may be offset by cash

consideration received from vendors, in accordance with arrangements such as cooperative advertising,

when earned for dollar amounts up to but not exceeding actual incremental costs. The Company

recognizes amounts received for cooperative advertising on performance, ‘‘first showing’’ or distribution,

consistent with its policy for advertising expense in accordance with applicable accounting standards for

reporting on advertising costs.

Prepaid expenses and other current assets

Prepaid expenses and other current assets include prepaid amounts for rent, maintenance,

advertising, and insurance, as well as amounts receivable for certain vendor rebates (primarily those

expected to be collected in cash), coupons, and other items.

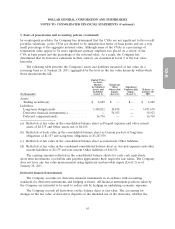

Property and equipment

Property and equipment are recorded at cost. The Company provides for depreciation and

amortization on a straight-line basis over the following estimated useful lives:

Land improvements ......................................... 20

Buildings ................................................. 39 - 40

Furniture, fixtures and equipment ............................... 3 - 10

Improvements of leased properties are amortized over the shorter of the life of the applicable

lease term or the estimated useful life of the asset.

Impairment of long-lived assets

When indicators of impairment are present, the Company evaluates the carrying value of long-lived

assets, other than goodwill, in relation to the operating performance and future cash flows or the

appraised values of the underlying assets. In accordance with accounting standards for long-lived assets,

the Company reviews for impairment stores open more than two years for which current cash flows

from operations are negative. Impairment results when the carrying value of the assets exceeds the

undiscounted future cash flows over the life of the lease. The Company’s estimate of undiscounted

future cash flows over the lease term is based upon historical operations of the stores and estimates of

future store profitability which encompasses many factors that are subject to variability and difficult to

predict. If a long-lived asset is found to be impaired, the amount recognized for impairment is equal to

the difference between the carrying value and the asset’s estimated fair value. The fair value is

estimated based primarily upon estimated future cash flows (discounted at the Company’s credit

adjusted risk-free rate) or other reasonable estimates of fair market value. Assets to be disposed of are

adjusted to the fair value less the cost to sell if less than the book value.

58