Dollar General 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

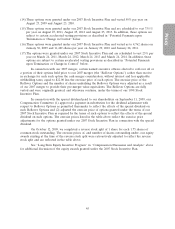

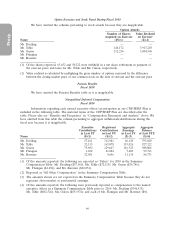

Proxy

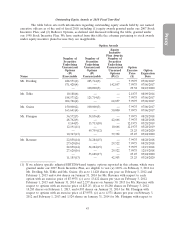

options with an exercise price of $12.1975; and (f) 12,440 shares per year on February 3, 2012 and

February 1, 2013, 12,439 shares on January 31, 2014 and 2,073 shares on January 30, 2015 for

Mr. Flanigan with respect to options with an exercise price of $25.25. If an annual adjusted

EBITDA-based target is not met, these options may still vest on a ‘‘catch up’’ basis if the

applicable cumulative adjusted EBITDA-based target is achieved at the end of fiscal years (1) 2011

or 2012 in the case of Mr. Dreiling, Mr. Tehle and Ms. Guion; (2) 2011, 2012, 2013, or 2014 in the

case of Mr. Ravener’s options identified in (b) above and Mr. Flanigan’s options identified in

(d) and (e) above; and (3) 2011, 2012, 2013, 2014, or 2015 in the case of Mr. Ravener’s and

Mr. Flanigan’s options identified in (c) and (f), respectively, above. These options also are subject

to certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or

Change in Control’’ below.

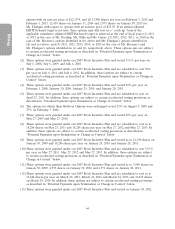

(2) These options were granted under our 2007 Stock Incentive Plan and vested 331⁄3% per year on

July 6, 2008, July 6, 2009, and July 6, 2010.

(3) These options were granted under our 2007 Stock Incentive Plan and are scheduled to vest 50%

per year on July 6, 2011 and July 6, 2012. In addition, these options are subject to certain

accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or Change in

Control’’ below.

(4) These options were granted under our 2007 Stock Incentive Plan and vested 25% per year on

February 1, 2008, January 30, 2009, January 29, 2010, and January 28, 2011.

(5) These options were granted under our 2007 Stock Incentive Plan and are scheduled to vest on

April 23, 2011. In addition, these options are subject to certain accelerated vesting provisions as

described in ‘‘Potential Payments upon Termination or Change in Control’’ below.

(6) The options for which these Rollover Options were exchanged vested 25% on August 9, 2005 and

75% on February 3, 2006.

(7) These options were granted under our 2007 Stock Incentive Plan and vested 50% per year on

May 27, 2009 and May 27, 2010.

(8) These options were granted under our 2007 Stock Incentive Plan and are scheduled to vest as to

18,286 shares on May 27, 2011 and 18,285 shares per year on May 27, 2012 and May 27, 2013. In

addition, these options are subject to certain accelerated vesting provisions as described in

‘‘Potential Payments upon Termination or Change in Control’’ below.

(9) These options were granted under our 2007 Stock Incentive Plan and vested as to 12,190 shares on

January 30, 2009 and 18,286 shares per year on January 29, 2010 and January 28, 2011.

(10) These options were granted under our 2007 Stock Incentive Plan and are scheduled to vest 331⁄3%

per year on May 27, 2011, May 27, 2012 and May 27, 2013. In addition, these options are subject

to certain accelerated vesting provisions as described in ‘‘Potential Payments upon Termination or

Change in Control’’ below.

(11) These options were granted under our 2007 Stock Incentive Plan and vested as to 3,048 shares on

January 30, 2009, 4,572 shares on January 29, 2010 and 4,571 shares on January 28, 2011.

(12) These options were granted under our 2007 Stock Incentive Plan and are scheduled to vest as to

12,440 shares per year on March 24, 2011, March 24, 2012 and March 24, 2013 and 12,439 shares

on March 24, 2014. In addition, these options are subject to certain accelerated vesting provisions

as described in ‘‘Potential Payments upon Termination or Change in Control’’ below.

(13) These options were granted under our 2007 Stock Incentive Plan and vested on January 28, 2011.

44