Dollar General 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

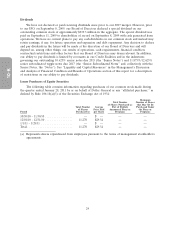

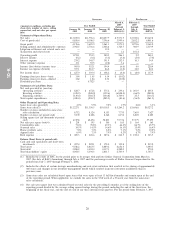

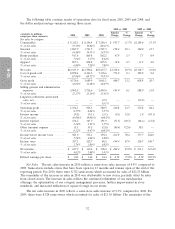

The following table contains results of operations data for fiscal years 2010, 2009 and 2008, and

the dollar and percentage variances among those years.

2010 vs. 2009 2009 vs. 2008

Amount % Amount %

(amounts in millions, 2010 2009 2008 Change Change Change Change

except per share amounts)

Net sales by category:

Consumables ................. $9,332.1 $ 8,356.4 $ 7,248.4 $ 975.7 11.7% $1,108.0 15.3%

% of net sales ................ 71.59% 70.84% 69.31%

Seasonal .................... 1,887.9 1,711.5 1,521.5 176.4 10.3 190.0 12.5

% of net sales ................ 14.48% 14.51% 14.55%

Home products ............... 917.6 869.8 862.2 47.9 5.5 7.5 0.9

% of net sales ................ 7.04% 7.37% 8.24%

Apparel .................... 897.3 858.8 825.6 38.6 4.5 33.2 4.0

% of net sales ................ 6.88% 7.28% 7.89%

Net sales ................... $13,035.0 $11,796.4 $10,457.7 $1,238.6 10.5% $1,338.7 12.8%

Cost of goods sold ............. 8,858.4 8,106.5 7,396.6 751.9 9.3 709.9 9.6

% of net sales ................ 67.96% 68.72% 70.73%

Gross profit ................. 4,176.6 3,689.9 3,061.1 486.7 13.2 628.8 20.5

% of net sales ................ 32.04% 31.28% 29.27%

Selling, general and administrative

expenses .................. 2,902.5 2,736.6 2,448.6 165.9 6.1 288.0 11.8

% of net sales ................ 22.27% 23.20% 23.41%

Litigation settlement and related

costs, net .................. — — 32.0 — — (32.0) —

% of net sales ................ — — 0.31%

Operating profit ............... 1,274.1 953.3 580.5 320.8 33.7 372.8 64.2

% of net sales ................ 9.77% 8.08% 5.55%

Interest income ............... (0.2) (0.1) (3.1) (0.1) 52.8 2.9 (95.3)

% of net sales ................ (0.00)% (0.00)% (0.03)%

Interest expense ............... 274.2 345.7 391.9 (71.5) (20.7) (46.2) (11.8)

% of net sales ................ 2.10% 2.93% 3.75%

Other (income) expense ......... 15.1 55.5 (2.8) (40.4) (72.8) 58.3 —

% of net sales ................ 0.12% 0.47% (0.03)%

Income before income taxes ...... 985.0 552.1 194.4 432.9 78.4 357.7 184.0

% of net sales ................ 7.56% 4.68% 1.86%

Income taxes ................. 357.1 212.7 86.2 144.4 67.9 126.5 146.7

% of net sales ................ 2.74% 1.80% 0.82%

Net income .................. $ 627.9 $ 339.4 $ 108.2 $ 288.4 85.0% $ 231.3 213.8%

% of net sales ................ 4.82% 2.88% 1.03%

Diluted earnings per share ....... $ 1.82 $ 1.04 $ 0.34 $ 0.78 75.0% $ 0.70 205.9%

Net Sales. The net sales increase in 2010 reflects a same-store sales increase of 4.9% compared to

2009. Same-stores include stores that have been open for 13 months and remain open at the end of the

reporting period. For 2010, there were 8,712 same-stores which accounted for sales of $12.23 billion.

The remainder of the increase in sales in 2010 was attributable to new stores, partially offset by sales

from closed stores. The increase in sales reflects the continued refinement of our merchandise

offerings, the optimization of our category management processes, further improvement in store

standards, and increased utilization of square footage in our stores.

The net sales increase in 2009 reflects a same-store sales increase of 9.5% compared to 2008. For

2009, there were 8,324 same-stores which accounted for sales of $11.36 billion. The remainder of the

32