Dollar General 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

requirement. Mr. Dreiling received an option agreement upon commencement of his employment with

us pursuant to the negotiated terms of his employment agreement.

The Committee has not made annual equity awards since our 2007 merger as it believes that

the long-term equity previously granted at the time of that merger or, for named executive officers who

were later employed by us, at the time of hire, have been sufficiently retentive and otherwise have

adequately met our current compensation objectives. The Committee has, however, made special

one-time equity grants to certain of our named executive officers in connection with promotions or,

with respect to Mr. Dreiling, in connection with amendment of his employment agreement, and is

contemplating the implementation of a new long-term equity program that incorporates an annual

grant component (discussed further below).

With respect to the promotion-related grants to Messrs. Flanigan and Ravener, the Committee

used a mathematical formula to determine both the number of options awarded and whether any

additional investment would be required by such officers to be eligible to receive the options awards.

That formula applied a mathematical proration of the level of investment and number of options

generally granted under the existing program to persons in senior vice president and executive vice

president positions over the period of time each such officer had served as a senior vice president and

will serve as an executive vice president during the five-year transfer restriction period that initially

began upon their respective employment dates. As a result of the application of such formula,

Mr. Flanigan made an additional investment of $158,299 as a condition to the exercisability of his

option award, while Mr. Ravener had already invested the minimum amount required to be eligible for

the promotion-related option award.

The options granted to the named executive officers (other than Mr. Dreiling’s April 2010

option award) are divided so that half are time-vested (generally over 4 or 5 years) and half are

performance-vested (generally over 5 or 6 years) based on a comparison of an EBITDA-based

performance metric, as described below, against pre-set goals for that performance metric. The

combination of time and performance-based vesting criteria is designed to compensate executives for

long-term commitment to us, while motivating sustained increases in our financial performance. See

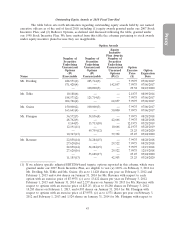

‘‘Grants of Plan-Based Awards in Fiscal 2010’’ and ‘‘Outstanding Equity Awards at 2010 Fiscal

Year-End’’ below.

The vesting of the performance-based options is subject to continued employment with us over

the performance period and the Board’s determination that we have achieved for each of the relevant

fiscal years the specified annual performance target based on EBITDA and adjusted as described

below. For fiscal years 2007, 2008, 2009 and 2010, those adjusted EBITDA targets were $700 million,

$828 million, $961 million, and $1.139 billion, respectively (except for Mr. Flanigan and Mr. Ravener’s

March 2010 promotion-related grants discussed below), which were based on the long-term financial

plan at the time of our 2007 merger, less any anticipated permissible adjustments, primarily to account

for unique expenses related to our 2007 merger. If a performance target for a given fiscal year is not

met, the performance-based options may still vest and become exercisable on a ‘‘catch up’’ basis if, at

the end of a subsequent fiscal year, a specified cumulative adjusted EBITDA performance target is

achieved. The annual and cumulative adjusted EBITDA performance targets are based on our

long-term financial plans in existence at the time of grant. Accordingly, in each case at the time of

grant, we believed those levels, while attainable, would require strong performance and execution.

Although Messrs. Flanigan and Ravener joined us during fiscal 2008 after the original performance

targets had been set for fiscal 2008, 2009, 2010 and 2011, the Committee decided to grant their

performance awards at the same performance targets as had been set for the other officers since the

long-term financial plans in place at that time had been determined relatively recently and to avoid

having different sets of performance levels for one member of the team applying to the same fiscal

years.

34