Dollar General 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

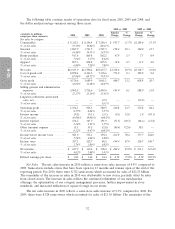

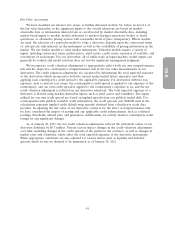

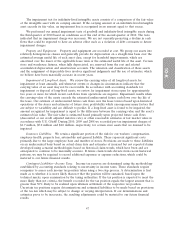

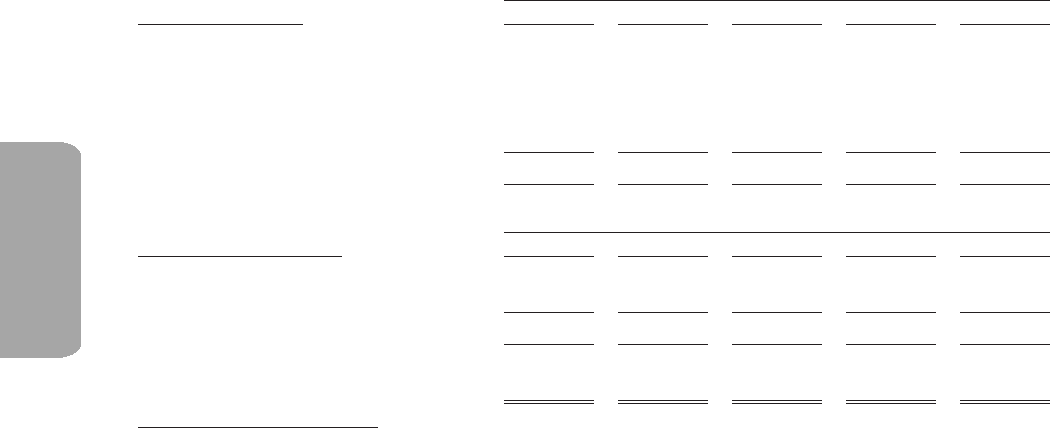

Contractual Obligations

The following table summarizes our significant contractual obligations and commercial

commitments as of January 28, 2011 (in thousands):

Payments Due by Period

Contractual obligations Total 1 year 1-3 years 3-5 years 5+ years

Long-term debt obligations ......... $3,293,025 $ — $ — $2,827,923 $ 465,102

Capital lease obligations ........... 6,363 1,157 999 679 3,528

Interest(a) ..................... 1,093,039 243,435 486,754 282,408 80,442

Self-insurance liabilities(b) ......... 213,736 78,540 85,881 30,265 19,050

Operating leases(c) .............. 3,003,342 481,921 839,585 614,080 1,067,756

Subtotal ..................... $7,609,505 $ 805,053 $1,413,219 $3,755,355 $1,635,878

Commitments Expiring by Period

Commercial commitments(d) Total 1 year 1-3 years 3-5 years 5+ years

Letters of credit ................ $ 19,059 $ 19,059 $ — $ — $ —

Purchase obligations(e) ........... 853,862 850,871 2,991 — —

Subtotal ..................... $ 872,921 $ 869,930 $ 2,991 $ — $ —

Total contractual obligations and

commercial commitments(f) ...... $8,482,426 $1,674,983 $1,416,210 $3,755,355 $1,635,878

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and

includes projected interest on variable rate long-term debt, using 2010 year end rates.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health

insurance, general liability, property loss and automobile insurance. As these obligations do not

have scheduled maturities, these amounts represent undiscounted estimates based upon actuarial

assumptions. Reserves for workers’ compensation and general liability which existed as of the date

of our 2007 merger were discounted in order to arrive at estimated fair value. All other amounts

are reflected on an undiscounted basis in our consolidated balance sheets.

(c) Operating lease obligations are inclusive of amounts included in deferred rent and closed store

obligations in our consolidated balance sheets.

(d) Commercial commitments include information technology license and support agreements,

supplies, fixtures, letters of credit for import merchandise, and other inventory purchase

obligations.

(e) Purchase obligations include legally binding agreements for software licenses and support, supplies,

fixtures, and merchandise purchases (excluding such purchases subject to letters of credit).

(f) We have potential payment obligations associated with uncertain tax positions that are not

reflected in these totals. We anticipate that approximately $0.2 million of such amounts will be

paid in the coming year. We are currently unable to make reasonably reliable estimates of the

period of cash settlement with the taxing authorities for our remaining $27.3 million of reserves for

uncertain tax positions.

42