Dollar General 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

If the named executive officer is involuntarily terminated without cause or resigns for good

reason, he or she will receive the same severance payments and benefits as described under ‘‘Voluntary

Termination with Good Reason or After Failure to Renew the Employment Agreement’’ above.

If any payments or benefits in connection with a change in control (as defined in Section 280G

of the Code) would be subject to the ‘‘golden parachute’’ excise tax under federal income tax rules, we

will pay an additional amount to the named executive officer to cover the excise tax and any other

excise and income taxes resulting from this payment. However, other than with respect to Mr. Dreiling,

if after receiving this payment the named executive officer’s after-tax benefit would not be at least

$50,000 more than it would be without this payment, then this payment will not be made and the

severance and other benefits due to the named executive officer will be reduced so that the golden

parachute excise tax is not incurred.

For purposes of the CDP/SERP Plan, a change in control generally is deemed to occur (as

more fully described in the plan document):

• if any person (other than Dollar General or any of our employee benefit plans) acquires

35% or more of our voting securities (other than as a result of our issuance of securities in

the ordinary course of business);

• if a majority of our Board members at the beginning of any consecutive 2-year period are

replaced within that period without the approval of at least 2⁄3 of our Board members who

served as directors at the beginning of the period; or

• upon the consummation of a merger, other business combination or sale of assets of, or cash

tender or exchange offer or contested election with respect to, Dollar General if less than a

majority of our voting securities are held after the transaction in the aggregate by holders of

our securities immediately prior to the transaction.

For purposes of the treatment of equity discussed above, a change in control generally means

(as more fully described in the Management Stockholder’s Agreement between us and the named

executive officers) one or a series of related transactions described below which results in us, KKR and

its affiliates or an employee benefit plan referenced below ceasing to hold the ability to elect (or cause

to be elected) a majority of our Board members:

• the sale of all or substantially all of the assets of Buck Holdings, L.P. or us and our

subsidiaries to any person (or group of persons acting in concert), other than to

(x) investment funds affiliated with KKR or its affiliates or (y) any employee benefit plan (or

trust forming a part thereof) maintained by us, KKR or our respective affiliates or other

person of which a majority of its voting power or other equity securities is owned, directly or

indirectly, by us, KKR or our respective affiliates; or

• a merger, recapitalization or other sale by us, KKR (indirectly) or any of our respective

affiliates, to a person (or group of persons acting in concert) of our common stock or our

other voting securities that results in more than 50% of our common stock or our other

voting securities (or any resulting company after a merger) being held, directly or indirectly,

by a person (or group of persons acting in concert) that is not controlled by (x) KKR or its

affiliates or (y) an employee benefit plan (or trust forming a part thereof) maintained by us,

KKR or our respective affiliates or other person of which a majority of its voting power or

other equity securities is owned, directly or indirectly, by us, KKR or our respective affiliates.

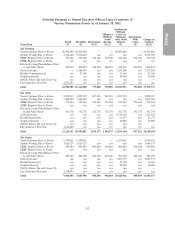

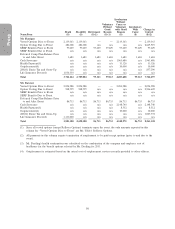

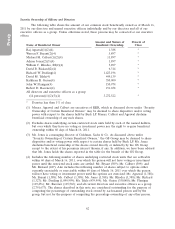

The following tables summarize the potential payments to our named executive officers upon

the occurrence of various termination of employment events as of the end of our most recently

completed fiscal year (i.e., January 28, 2011).

54