Dollar General 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

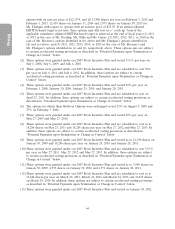

• Payment of the premiums on certain personal long-term disability insurance policies (which

was required under the prior agreement).

• Personal use of our plane for no more than 80 hours per year unless a greater number of

hours is specified by the Committee.

• Payment of monthly membership fees and costs related to his membership in professional

clubs selected by him, grossed-up for any taxes (which was required under the prior

agreement).

• Four weeks of paid vacation annually (which was required under the prior agreement).

• Reimbursement of reasonable legal fees, up to $15,000 and grossed up for all federal and

state income and employment taxes (and for such taxes on such gross-up payment) to the

extent any such amount is taxable to Mr. Dreiling, incurred by him in connection with any

legal consultation regarding the amended employment agreement.

In addition, effective April 23, 2010, the 162(m) Subcommittee granted Mr. Dreiling a

non-qualified stock option to purchase 100,000 shares of our common stock. While the option and the

common stock underlying the option are subject to the terms of the existing Management Stockholder’s

Agreement between us and Mr. Dreiling, they are not subject to the transfer restrictions and put and

call provisions set forth in Sections 3, 5 and 6 thereof. The Committee believed this award was of a

sufficient size to appropriately reward Mr. Dreiling for Dollar General’s tremendous performance

results while continuing to incent future performance.

Severance Arrangements

As noted above, we have an employment agreement with each of our named executive officers

that, among other things, provides for such executive’s rights upon a termination of employment. We

believe that reasonable severance benefits are appropriate to protect the named executive officer

against circumstances over which he or she does not have control and as consideration for the promises

of non-disclosure, non-competition, non-solicitation and non-interference that we require in our

employment agreements.

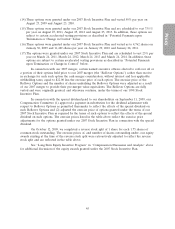

A change in control, by itself, does not trigger any severance provision applicable to our named

executive officers, except for the provisions related to long-term equity incentives under our 2007 Stock

Incentive Plan. As required by applicable securities laws, we have included a summary of our severance

and change in control arrangements as they existed as of the end of fiscal year 2010 (that is, as of

January 28, 2011) under ‘‘Potential Payments upon Termination or Change in Control as of January 28,

2011’’ below.

Considerations Associated with Regulatory Requirements

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to any

publicly held corporation for individual compensation over $1 million paid in any taxable year to each

of the persons who were, at the end of the fiscal year, Dollar General’s CEO or one of the other

named executive officers (other than our Chief Financial Officer). Section 162(m) specifically exempts

certain performance-based compensation from the deduction limit.

If our Compensation Committee determines that our shareholders’ interests are best served by

the implementation of compensation policies that are affected by Section 162(m), our policies will not

restrict the Committee from exercising discretion to approve compensation packages even though that

flexibility may result in certain non-deductible compensation expenses.

We believe that our 2007 Stock Incentive Plan satisfies the requirements of Section 162(m), so

that compensation expense realized in connection with stock options and stock appreciation rights, if

37