Dollar General 2010 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

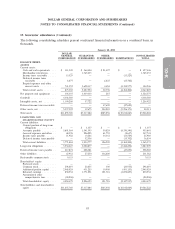

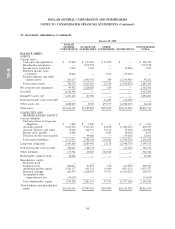

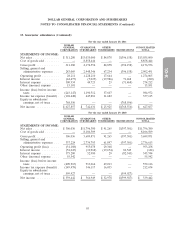

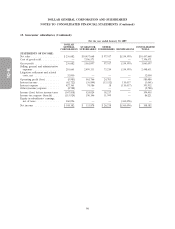

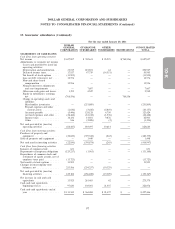

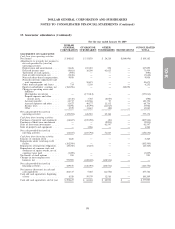

11. Share-based payments (Continued)

The Company currently believes that the performance targets related to the unvested Performance

Options will be achieved. If such goals are not met, and there is no change in control or certain public

offerings of the Company’s common stock which would result in the acceleration of vesting of the

Performance Options, future compensation cost relating to unvested Performance Options will not be

recognized.

Through January 28, 2011, all Time Options and Performance Options have been granted to

employees. During the fourth quarter of 2009, the Company granted 33,051 non-qualified stock options

to members of its Board of Directors. These options vest ratably on an annual basis over a four year

period from the date of grant.

In January 2008, the Company granted 508,572 nonvested restricted shares to its Chief Executive

Officer. As a result of the Company’s initial public offering these shares vested, at a total fair value

equal to $11.5 million. Subsequent to the offering, the Company granted a total of 9,084 restricted

stock unit awards to members of its Board of Directors. For 2010, 2009 and 2008, the share-based

compensation expense related to nonvested shares before income taxes was less than $0.1 million,

$3.3 million ($2.0 million net of tax) and $1.1 million ($0.7 million net of tax), respectively. At

January 28, 2011, the total compensation cost related to nonvested restricted stock awards not yet

recognized was approximately $0.1 million.

All nonvested restricted stock and restricted stock unit awards granted in the periods presented

had a purchase price of zero. The Company records compensation expense on a straight-line basis over

the restriction period based on the market price of the underlying stock on the date of grant. The

nonvested restricted stock unit awards granted under the plan to non-employee directors during 2009

vested or are scheduled to vest in one-third increments at each of the Company’s three subsequent

annual shareholder meetings.

12. Related party transactions

Affiliates of certain of the Investors participated as (i) lenders in the Company’s Credit Facilities

discussed in Note 7; (ii) initial purchasers of the Company’s Notes discussed in Note 7;

(iii) counterparties to certain interest rate swaps discussed in Note 8 and (iv) as advisors in the Merger.

The Company believes affiliates of KKR and Goldman, Sachs & Co. (among other entities) are

lenders under the Term Loan Facility. The amount of principal outstanding under the Term Loan

Facility from the date of the Merger to September 30, 2009, was $2.3 billion. The Company paid

principal of $336.5 million during the remainder of 2009 and approximately $53.4 million, $74.8 million

and $133.4 million of interest on the Term Loan Facility during 2010, 2009 and 2008, respectively.

Goldman, Sachs & Co. is a counterparty to an amortizing interest rate swap with a notional

amount of $323.3 million and $396.7 million as of January 28, 2011 and January 29, 2010, respectively,

entered into in connection with the Term Loan Facility. The Company paid Goldman, Sachs & Co.

approximately $12.9 million, $17.9 million and $9.5 million in 2010, 2009 and 2008, respectively,

pursuant to the interest rate swap as further discussed in Note 8.

89