Dollar General 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

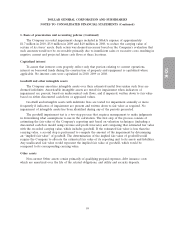

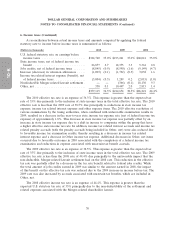

Accrued expenses and other liabilities

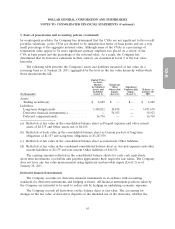

Accrued expenses and other consist of the following:

January 28, January 29,

(In thousands) 2011 2010

Compensation and benefits ......................... $ 81,786 $100,843

Insurance ...................................... 76,372 65,408

Taxes (other than taxes on income) ................... 74,900 72,902

Other ......................................... 114,683 103,137

$347,741 $342,290

Other accrued expenses primarily include the current portion of liabilities for legal settlements,

freight expense, contingent rent expense, interest, utilities, common area and other maintenance

charges, and income tax related reserves.

Insurance liabilities

The Company retains a significant portion of risk for its workers’ compensation, employee health,

general liability, property and automobile claim exposures. Accordingly, provisions are made for the

Company’s estimates of such risks. The undiscounted future claim costs for the workers’ compensation,

general liability, and health claim risks are derived using actuarial methods. To the extent that

subsequent claim costs vary from those estimates, future results of operations will be affected. Ashley

River Insurance Company (or ARIC, as defined above), a South Carolina-based wholly owned captive

insurance subsidiary of the Company, charges the operating subsidiary companies premiums to insure

the retained workers’ compensation and non-property general liability exposures. Pursuant to South

Carolina insurance regulations, ARIC is required to maintain certain levels of cash and cash

equivalents related to its self insured exposures. ARIC currently insures no unrelated third-party risk.

As a result of the Merger discussed in Note 3, the Company recorded its assumed self-insurance

reserves as of the Merger date at their present value in accordance with applicable accounting

standards for business combinations, using a discount rate of 5.4%. The balance of the resulting

discount was $4.8 million and $7.4 million at January 28, 2011 and January 29, 2010, respectively. Other

than for reserves assumed in a business combination, the Company’s policy is to record self-insurance

reserves on an undiscounted basis.

Operating leases and related liabilities

Rent expense is recognized over the term of the lease. The Company records minimum rental

expense on a straight-line basis over the base, non-cancelable lease term commencing on the date that

the Company takes physical possession of the property from the landlord, which normally includes a

period prior to the store opening to make necessary leasehold improvements and install store fixtures.

When a lease contains a predetermined fixed escalation of the minimum rent, the Company recognizes

the related rent expense on a straight-line basis and records the difference between the recognized

rental expense and the amounts payable under the lease as deferred rent. Tenant allowances, to the

extent received, are recorded as deferred incentive rent and are amortized as a reduction to rent

expense over the term of the lease. Any difference between the calculated expense and the amounts

60