Dollar General 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

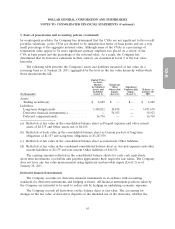

1. Basis of presentation and accounting policies (Continued)

Management estimates

The preparation of financial statements and related disclosures in conformity with accounting

principles generally accepted in the United States requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the consolidated financial statements and the reported amounts of

revenues and expenses during the reporting periods. Actual results could differ from those estimates.

Accounting standards

In June 2009 the FASB issued a new accounting standard relating to variable interest entities. This

standard amends previous standards and requires an enterprise to perform an analysis to determine

whether the enterprise’s variable interest or interests give it a controlling financial interest in a variable

interest entity, specifies updated criteria for determining the primary beneficiary, requires ongoing

reassessments of whether an enterprise is the primary beneficiary of a variable interest entity,

eliminates the quantitative approach previously required for determining the primary beneficiary of a

variable interest entity, amends certain guidance for determining whether an entity is a variable interest

entity, requires enhanced disclosures about an enterprise’s involvement in a variable interest entity,

among other provisions. This standard was effective as of the beginning of the Company’s 2010

reporting periods. The adoption of this standard did not have a material effect on the Company’s

consolidated financial statements.

Reclassifications

Certain reclassifications of the 2008 and 2009 amounts have been made to conform to the 2010

presentation.

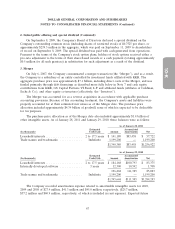

2. Initial public offering and special dividend

On November 18, 2009, the Company completed the initial public offering of its common stock.

The Company issued 22,700,000 shares in the offering, and an existing shareholder sold an additional

16,515,000 outstanding shares. Net proceeds to the Company from the offering of $446.0 million were

used to redeem outstanding debt, as discussed in more detail in Note 7 below. The Company paid a

$4.8 million transaction fee to Kohlberg Kravis Roberts & Co., L.P. (‘‘KKR’’) and Goldman,

Sachs & Co. in connection with the offering. Although this transaction fee was not paid from the net

proceeds of the offering, it was directly related to the offering and accounted for as a cost of raising

equity.

Upon the completion of the offering, the Company incurred additional charges of $58.8 million for

fees paid to terminate its advisory agreement with KKR and Goldman, Sachs & Co. The transaction

and termination fees paid to such parties are discussed in more detail in Note 12 below. The Company

also incurred charges of $9.4 million for the accelerated vesting of certain share-based awards as

discussed in more detail in Note 11 below.

66