Dollar General 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

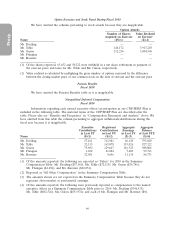

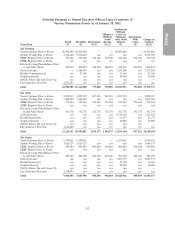

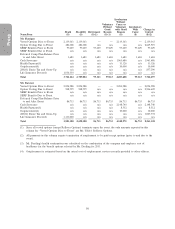

Proxy

Involuntary

Without

Voluntary Cause or

Without Voluntary Involuntary

Good with Good With Change in

Death Disability Retirement Reason Reason Cause Control

Name/Item ($) ($) ($)(1) ($)(1) ($) ($) ($)(2)

Mr. Flanigan

Vested Options Prior to Event 2,119,363 2,119,363 — — 2,119,363 — 2,119,363

Option Vesting Due to Event 486,328 486,328 n/a n/a n/a n/a 2,665,519

SERP Benefits Prior to Event 97,629 97,629 97,629 97,629 97,629 97,629 97,629

SERP Benefits Due to Event n/a n/a n/a n/a n/a n/a n/a

Deferred Comp Plan Balance Prior

to and After Event 1,683 1,683 1,683 1,683 1,683 1,683 1,683

Cash Severance n/a n/a n/a n/a 1,961,686 n/a 1,961,686

Health Payment(3) n/a n/a n/a n/a 13,326 n/a 13,326

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a 857,290

Life Insurance Proceeds 1,016,110 n/a n/a n/a n/a n/a n/a

Total 3,721,114 2,705,004 99,313 99,313 4,203,688 99,313 7,726,497

Mr. Ravener

Vested Options Prior to Event 2,094,988 2,094,988 — — 2,094,988 — 2,094,988

Option Vesting Due to Event 508,599 508,599 n/a n/a n/a n/a 2,906,605

SERP Benefits Prior to Event n/a n/a n/a n/a n/a n/a n/a

SERP Benefits Due to Event n/a n/a n/a n/a n/a n/a n/a

Deferred Comp Plan Balance Prior

to and After Event 86,733 86,733 86,733 86,733 86,733 86,733 86,733

Cash Severance n/a n/a n/a n/a 2,148,740 n/a 2,148,740

Health Payment(3) n/a n/a n/a n/a 8,512 n/a 8,512

Outplacement(4) n/a n/a n/a n/a 10,000 n/a 10,000

280(G) Excise Tax and Gross-Up n/a n/a n/a n/a n/a n/a 1,007,772

Life Insurance Proceeds 1,113,000 n/a n/a n/a n/a n/a n/a

Total 3,803,320 2,690,320 86,733 86,733 4,348,972 86,733 8,263,350

(1) Since all vested options (except Rollover Options) terminate upon the event, the only amounts reported in this

column for ‘‘Vested Options Prior to Event’’ are Mr. Tehle’s Rollover Options.

(2) All payments in this column require termination of employment to be paid except options (prior to and due to the

event).

(3) Mr. Dreiling’s health continuation was calculated on the combination of the company and employee cost of

healthcare for the benefit options selected by Mr. Dreiling for 2011.

(4) Outplacement is estimated based on the actual cost of outplacement services recently provided to other officers.

56