Dollar General 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

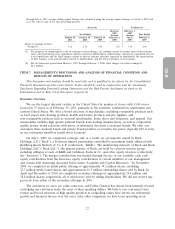

10-K

evaluate a store for relocation opportunities approximately 18 months prior to the store’s lease

expiration using the same basic tools and criteria as those used for new stores. Remodels, which require

a much smaller investment, are determined based on the need, the opportunity for sales improvement

at the location and an expectation of a desirable return on investment.

Key Financial Metrics. We have identified the following as our most critical financial metrics for

2011:

• Same-store sales growth;

• Sales per square foot;

• Gross profit, as a percentage of sales;

• Operating profit;

• Inventory turnover;

• Cash flow;

• Net income;

• Earnings per share;

• Earnings before interest, income taxes, depreciation and amortization; and

• Return on invested capital.

Readers should refer to the detailed discussion of our operating results below for additional

comments on financial performance in the current year periods as compared with the prior year

periods.

Results of Operations

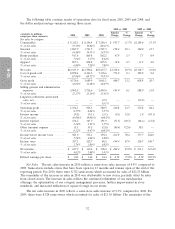

Accounting Periods. The following text contains references to years 2010, 2009 and 2008, which

represent fiscal years ended January 28, 2011, January 29, 2010 and January 30, 2009, respectively. Our

fiscal year ends on the Friday closest to January 31. Fiscal years 2010, 2009 and 2008 were 52-week

accounting periods.

Seasonality. The nature of our business is seasonal to a certain extent. Primarily because of sales

of holiday-related merchandise, sales in our fourth quarter (November, December and January) have

historically been higher than sales achieved in each of the first three quarters of the fiscal year.

Expenses and, to a greater extent, operating profit vary by quarter. Results of a period shorter than a

full year may not be indicative of results expected for the entire year. Furthermore, the seasonal nature

of our business may affect comparisons between periods.

31