Dollar General 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

We do not compensate for Board service any director who simultaneously serves as a Dollar

General employee. We will reimburse directors for certain fees and expenses incurred in connection

with continuing education seminars and for travel and related expenses related to Dollar General

business. We may allow directors to travel on the Dollar General airplane for those purposes.

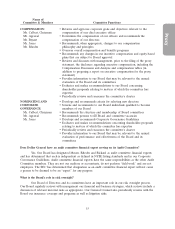

Each non-employee director receives quarterly payment of the following cash compensation, as

applicable:

• $75,000 annual retainer for service as a Board member;

• $17,500 annual retainer for service as chairman of the Audit Committee;

• $15,000 annual retainer for service as chairman of the Compensation Committee;

• $10,000 annual retainer for service as chairman of the Nominating and Corporate

Governance Committee; and

• $1,500 for each Board or committee meeting in excess of an aggregate of 12 that a director

attends during each fiscal year.

In addition to the director compensation described above, each non-employee director received

in our 2009 fiscal year an equity award with an estimated value of $75,000 on the grant date. Sixty

percent of the value of the equity grant consisted of non-qualified stock options to purchase shares of

our common stock (‘‘Options’’) and 40% consisted of restricted stock units ultimately payable in shares

of our common stock (‘‘RSUs’’). The Options vest as to 25% of the Option on each of the first four

anniversaries of the grant date and the RSUs vest as to 331⁄3% of the award on each of our first three

annual shareholders’ meetings following the grant date, each subject to the director’s continued service

on our Board. Our directors may elect to defer receipt of shares under the RSUs. We did not grant an

annual equity award to our non-employee directors in fiscal 2010.

Beginning in our 2011 fiscal year, each non-employee director will receive an annual equity

award with an estimated value of $75,000 on the grant date as determined by the Compensation

Committee’s consultant using economic variables such as the trading price of our common stock,

expected volatility of the stock trading prices of similar companies, and the terms of the awards. We

anticipate that 60% of the value of the annual equity award will consist of Options and 40% will

consist of RSUs. We expect that the Options will vest as to 25% of the Option on each of the first four

anniversaries of the grant date and that the RSUs will vest as to 331⁄3% of the award on each of the

Company’s first three annual shareholders’ meetings following the grant date, each subject to the

director’s continued service on our Board. The directors may elect to defer receipt of shares underlying

the RSUs.

The effective date of the annual equity awards (the ‘‘grant date’’) is expected to be the date on

which the quarterly Board meeting is held in conjunction with the Company’s annual shareholders’

meeting, and such awards shall be made to those directors who are elected or reelected at such

shareholders’ meeting. Any new director appointed after the annual shareholders’ meeting but before

February 1 of a given year will receive a full equity award no later than the first Compensation

Committee meeting following the date on which he or she is elected. Any new director appointed on or

after February 1 of a given year but before the next annual shareholders’ meeting shall not receive a

full or pro-rated equity award, but rather shall be eligible to receive the next regularly scheduled

annual award.

18