Dollar General 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

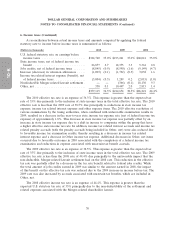

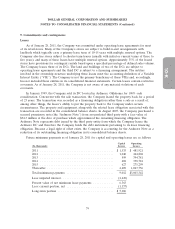

6. Income taxes (Continued)

The consolidated statements of income for the respective years reflected below include the

following amounts:

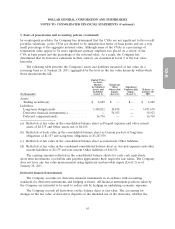

(In thousands) 2010 2009 2008

Income tax expense (benefit) ................... $(12,000) $11,900 $ 800

Income tax related interest expense (benefit) ....... (5,800) 2,300 (1,000)

Income tax related penalty expense (benefit) ....... (700) 400 300

A reconciliation of the uncertain income tax positions from February 1, 2008 through January 28,

2011 is as follows:

(In thousands) 2010 2009 2008

Beginning balance .......................... $67,636 $59,057 $ 96,600

Increases—tax positions taken in the current year . . . 125 13,701 25,977

Decreases—tax positions taken in the current year . . — — (2,250)

Increases—tax positions taken in prior years ....... — 4,039 3,271

Decreases—tax positions taken in prior years ...... (36,973) (1,111) (58,607)

Statute expirations ......................... (1,570) — (1,955)

Settlements ............................... (2,789) (8,050) (3,979)

Ending balance ............................ $26,429 $67,636 $ 59,057

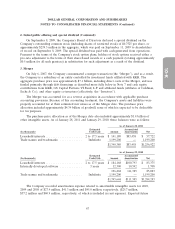

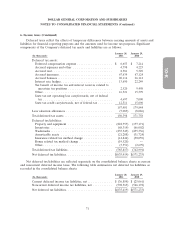

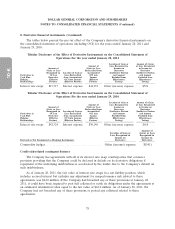

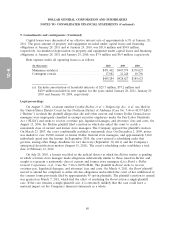

7. Current and long-term obligations

Current and long-term obligations consist of the following:

(In thousands) January 28, 2011 January 29, 2010

Senior secured term loan facility ............... $1,963,500 $1,963,500

ABL Facility ............................. — —

105⁄8% Senior Notes due July 15, 2015, net of

discount of $11,161 and $14,788, respectively .... 853,172 964,545

117⁄8/125⁄8% Senior Subordinated Notes due July 15,

2017 .................................. 450,697 450,697

85⁄8% Notes due June 15, 2010 ................ — 1,822

Capital lease obligations ..................... 6,363 8,327

Tax increment financing due February 1, 2035 ..... 14,495 14,495

3,288,227 3,403,386

Less: current portion ....................... (1,157) (3,671)

Long-term portion ......................... $3,287,070 $3,399,715

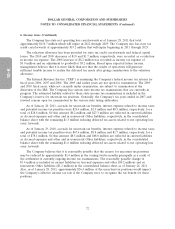

The Company entered into two senior secured credit agreements (the ‘‘Credit Facilities’’) at the

time of the Merger. As of January 28, 2011, the Credit Facilities provide total financing of

$2.995 billion, consisting of $1.964 billion in a senior secured term loan facility (‘‘Term Loan Facility’’)

which matures on July 6, 2014, and a senior secured asset-based revolving credit facility (‘‘ABL

Facility’’) of up to $1.031 billion, subject to borrowing base availability, which matures on July 6, 2013.

73