Dollar General 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

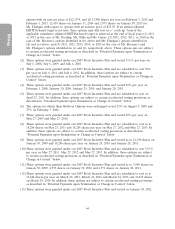

which represents the aggregate incremental cost of providing certain perquisites, including $254,886 for costs

associated with personal airplane usage by Mr. Dreiling and his guests, $20,174 for costs associated with

financial and estate planning services, and other amounts which individually did not equal or exceed the

greater of $25,000 or 10% of total perquisites, including expenses related to attendance by Mr. Dreiling and

his guests at entertainment events, event participation and appreciation gifts, costs incurred in connection with

a medical physical examination, and minimal incremental travel expenses incurred by Mr. Dreiling’s spouse

accompanying him on Dollar General business. The aggregate incremental cost related to the personal

airplane usage was calculated using costs we would not have incurred but for the usage (including costs

incurred as a result of ‘‘deadhead’’ legs of personal flights), including fuel costs, maintenance costs, crew

expenses, landing, parking and other associated fees, supplies and catering costs.

(6) Amount has been adjusted from the amount reported in the prior year proxy statement to add the following

amount for a tax gross-up related to the financial and estate planning perquisite in 2009 that was not

determinable until the end of 2010: Mr. Dreiling ($2,275); Mr. Tehle ($2,950); and Ms. Guion ($2,950).

(7) Includes $145,278 for our contribution to the SERP and $19,799 and $12,312, respectively, for our match

contributions to the CDP and the 401(k) Plan; $6,114 for tax gross-ups related to the financial and estate

planning perquisite, $3,852 for tax gross-ups related to life and disability insurance premiums, and $709 for

other miscellaneous tax gross-ups; $3,447 for premiums paid under our life and disability insurance programs;

and $27,939 which represents the aggregate incremental cost of providing certain perquisites, including

$19,260 for financial and estate planning services, and other amounts which individually did not equal or

exceed the greater of $25,000 or 10% of total perquisites, including expenses related to attendance by

Mr. Tehle and his guests at entertainment events, event participation, holiday and appreciation gifts, and a

directed donation to charity.

(8) Includes $110,906 for our contribution to the SERP and $18,741 and $12,336, respectively, for our match

contributions to the CDP and the 401(k) Plan; $6,114 for tax gross-ups related to the financial and estate

planning perquisite, $6,168 for tax gross-ups related to life and disability insurance premiums, and $561 for

other miscellaneous tax gross-ups; $3,978 for premiums paid under our life and disability insurance programs;

and $27,357 which represents the aggregate incremental cost of providing certain perquisites, including

$19,430 for financial and estate planning services, and other amounts which individually did not equal or

exceed the greater of $25,000 or 10% of total perquisites, including a directed donation to charity, expenses

related to attendance by Ms. Guion and her guests at entertainment events, event participation, holiday and

appreciation gifts, and minimal incremental travel expenses incurred by Ms. Guion’s guest while

accompanying her on Dollar General business.

(9) Includes $61,284 for our contribution to the SERP and $12,261 for our match contributions to the 401(k)

plan; $6,114 for tax gross-ups related to the financial and estate planning perquisite, $4,370 for tax gross-ups

related to life and disability insurance premiums, and $702 for other miscellaneous tax gross-ups; $3,599 for

premiums paid under our life and disability insurance program; and $24,337 which represents the aggregate

incremental cost of providing certain perquisites, including $19,430 for financial and estate planning services,

and other amounts which individually did not equal or exceed the greater of $25,000 or 10% of total

perquisites, including expenses related to attendance by Mr. Flanigan and his guests at entertainment events,

event participation, holiday and appreciation gifts, and minimal incremental costs associated with personal

airplane usage by Mr. Flanigan.

(10) Includes $12,350 and $9,696 for our match contributions to the 401(k) Plan and the CDP; $6,114 for tax

gross-ups related to the financial and estate planning perquisite, $1,683 for a tax-gross related to life

insurance premiums, and $657 for other miscellaneous tax gross-ups; $721 for premiums paid under our life

insurance program; and $32,284 which represents the aggregate incremental cost of providing certain

perquisites, including $19,673 for financial and estate planning services, and other amounts which individually

did not equal or exceed the greater of $25,000 or 10% of total perquisites, including a directed donation to

charity, expenses related to attendance by Mr. Ravener and his guests at entertainment events, event

participation, holiday and appreciation gifts, and costs incurred in connection with a medical physical

examination.

40