Dollar General 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

Company has elected to designate a derivative in a hedging relationship and apply hedge accounting

and whether the hedging relationship has satisfied the criteria necessary to apply hedge accounting.

Derivatives designated and qualifying as a hedge of the exposure to changes in the fair value of an

asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are

considered fair value hedges. Derivatives designated and qualifying as a hedge of the exposure to

variability in expected future cash flows, or other types of forecasted transactions, are considered cash

flow hedges. Derivatives may also be designated as hedges of the foreign currency exposure of a net

investment in a foreign operation. Hedge accounting generally provides for the matching of the timing

of gain or loss recognition on the hedging instrument with the recognition of the changes in the fair

value of the hedged asset or liability that are attributable to the hedged risk in a fair value hedge or

the earnings effect of the hedged forecasted transactions in a cash flow hedge. The Company may enter

into derivative contracts that are intended to economically hedge a certain portion of its risk, even

though hedge accounting does not apply or the Company elects not to apply the hedge accounting

standards.

The Company’s derivative financial instruments, in the form of interest rate swaps at January 28,

2011, are related to variable interest rate risk exposures associated with the Company’s long-term debt

and were entered into in an effort to manage that risk. The counterparties to the Company’s derivative

agreements are all major international financial institutions. The Company continually monitors its

position and the credit ratings of its counterparties and does not anticipate nonperformance by the

counterparties; however, there can be no assurance that such nonperformance will not occur.

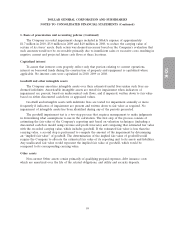

Revenue and gain recognition

The Company recognizes retail sales in its stores at the time the customer takes possession of

merchandise. All sales are net of discounts and estimated returns and are presented net of taxes

assessed by governmental authorities that are imposed concurrent with those sales. The liability for

retail merchandise returns is based on the Company’s prior experience. The Company records gain

contingencies when realized.

The Company recognizes gift card sales revenue at the time of redemption. The liability for the

gift cards is established for the cash value at the time of purchase. The liability for outstanding gift

cards was approximately $2.4 million and $1.9 million at January 28, 2011 and January 29, 2010,

respectively, and is recorded in Accrued expenses and other liabilities. Through January 28, 2011, the

Company has not recorded any breakage income related to its gift card program.

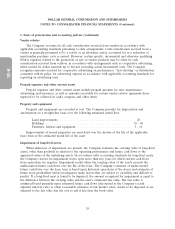

Advertising costs

Advertising costs are expensed upon performance, ‘‘first showing’’ or distribution, and are reflected

net of qualifying cooperative advertising funds provided by vendors in SG&A expenses. Advertising

costs were $46.9 million, $41.5 million and $27.8 million in 2010, 2009 and 2008, respectively. These

costs primarily include promotional circulars, targeted circulars supporting new stores, television and

radio advertising, in-store signage, and costs associated with the sponsorships of certain automobile

racing activities. Vendor funding for cooperative advertising offset reported expenses by $14.2 million,

$9.0 million and $7.8 million in 2010, 2009 and 2008, respectively.

64