Dollar General 2010 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

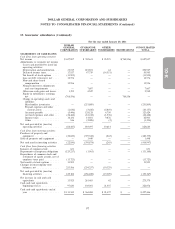

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

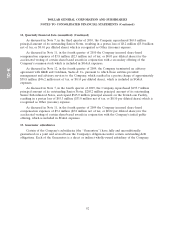

15. Guarantor subsidiaries (Continued)

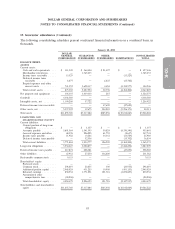

For the year ended January 29, 2010

DOLLAR

GENERAL GUARANTOR OTHER CONSOLIDATED

CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF CASH FLOWS:

Cash flows from operating activities:

Net income .................. $339,442 $ 566,949 $ 32,978 $(599,927) $ 339,442

Adjustments to reconcile net income to

net cash provided by (used in)

operating activities:

Depreciation and amortization .... 36,541 220,048 182 — 256,771

Deferred income taxes ......... (18,571) 67,317 (33,886) — 14,860

Tax benefit of stock options ...... (5,390) — — — (5,390)

Loss on debt retirement, net ...... 55,265 — — — 55,265

Non-cash share-based compensation . 17,295 — — — 17,295

Noncash inventory adjustments and

asset impairments ........... — 647 — — 647

Other non-cash gains and losses . . . 3,221 4,699 — — 7,920

Equity in subsidiaries’ earnings, net . (599,927) — — 599,927 —

Change in operating assets and

liabilities:

Merchandise inventories ....... — (100,248) — — (100,248)

Prepaid expenses and other current

assets ................. 2,582 (10,252) 372 — (7,298)

Accounts payable ........... 26,535 79,515 (1) — 106,049

Accrued expenses and other .... (20,672) 10,494 (2,465) — (12,643)

Income taxes .............. 48,494 (50,112) 2,771 — 1,153

Other .................. (3,203) 2,171 32 — (1,000)

Net cash provided by (used in)

operating activities ............ (118,388) 791,228 (17) — 672,823

Cash flows from investing activities:

Purchases of property and equipment . . (34,647) (216,032) (68) — (250,747)

Sales of property and equipment .... — 2,701 — — 2,701

Net cash used in investing activities . . . (34,647) (213,331) (68) — (248,046)

Cash flows from financing activities:

Issuance of common stock ........ 443,753 — — — 443,753

Issuance of long-term obligations .... — 1,080 — — 1,080

Repayments of long-term obligations . . (782,518) (2,742) — — (785,260)

Payment of cash dividends and related

amounts .................. (239,731) — — — (239,731)

Repurchases of common stock and

settlement of equity awards, net of

employee taxes paid ........... (5,928) — — — (5,928)

Tax benefit of stock options ........ 5,390 — — — 5,390

Changes in intercompany note balances,

net...................... 537,052 (537,638) 586 — —

Net cash provided by (used in)

financing activities ............ (41,982) (539,300) 586 — (580,696)

Net increase (decrease) in cash and

cash equivalents ............. (195,017) 38,597 501 — (155,919)

Cash and cash equivalents, beginning of

year ..................... 292,637 64,404 20,954 — 377,995

Cash and cash equivalents, end of year . $ 97,620 $ 103,001 $ 21,455 $ — $ 222,076

98