Dollar General 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

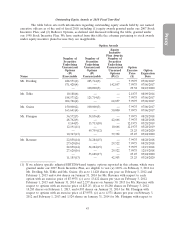

For Mr. Flanigan and Mr. Ravener’s promotion-related option grants in 2010, the Committee

determined that the EBITDA targets for the performance-based options should be set based on the

updated adjusted EBITDA forecast in our long-term business plan. The target for fiscal year 2010 was

$1.4 billion. At the time of grant, we believed the annual adjusted EBITDA levels, while attainable,

would require strong performance and execution.

For purposes of calculating the achievement of performance targets for our long-term equity

incentive program, ‘‘EBITDA’’ means earnings before interest, taxes, depreciation and amortization plus

transaction, management and/or similar fees paid to KKR and/or its affiliates. In addition, the Board is

required to fairly and appropriately adjust the calculation of EBITDA to reflect, to the extent not

contemplated in our financial plan, the following: acquisitions, divestitures, any change required by

generally accepted accounting principles (‘‘GAAP’’) relating to share-based compensation or for other

changes in GAAP promulgated by accounting standard setters that, in each case, the Board in good

faith determines require adjustment to the EBITDA performance metric we use for our long-term

equity incentive program. Adjustments to EBITDA for purposes of calculating performance targets for

our long-term equity incentive program may not in all circumstances be identical to adjustments to

EBITDA for other purposes, including our Teamshare program targets and the covenants contained in

our principal financial agreements. Accordingly, comparability of such measures is limited.

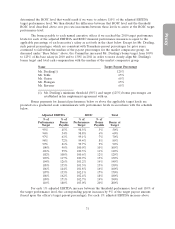

We have surpassed the cumulative adjusted EBITDA performance targets through fiscal 2010,

and we anticipate surpassing the cumulative adjusted EBITDA performance target through fiscal 2011,

for all options except for the promotion-related option grants awarded to Messrs. Flanigan and

Ravener. For such promotion-related awards, we exceeded the 2010 annual adjusted EBITDA

performance target.

Over the last year, the Committee has been working with its consultant and with management

to develop a new long-term equity incentive structure under the 2007 Stock Incentive Plan that is more

in line with typical public company equity structures. We expect that the new structure will contain an

annual grant component and not retain the mandatory investment feature or the transfer restrictions,

put rights, call rights, and piggyback registration rights contained in the Management Stockholder’s

Agreement. We anticipate that the new structure will be partly implemented in May 2011 for new hire

equity awards and fully implemented in March 2012 for annual equity awards. The structure and the

timing of the program remain subject to change until grants are approved by the 162(m) Subcommittee.

Benefits and Perquisites. Along with certain benefits offered to named executive officers on the

same terms that are offered to all of our salaried employees (such as health and welfare benefits and

matching contributions under our 401(k) plan), we provide our named executive officers with certain

additional benefits and perquisites for retention and recruiting purposes, to promote tax efficiency for

such persons, and to replace benefit opportunities lost due to regulatory limits. We also provide named

executive officers with benefits and perquisites as additional forms of compensation that we believe to

be consistent and competitive with benefits and perquisites provided to executives with similar positions

in our market comparator group and in our industry.

The named executive officers have the opportunity to participate in the Compensation Deferral

Plan (the ‘‘CDP’’) and, other than Mr. Ravener, the defined contribution Supplemental Executive

Retirement Plan (the ‘‘SERP’’, and together with the CDP, the ‘‘CDP/SERP Plan’’). The Compensation

Committee previously determined to no longer offer SERP participation to persons to whom

employment offers are made after May 28, 2008, including newly hired executive officers.

We provide each named executive officer a life insurance benefit equal to 2.5 times his or her

base salary up to a maximum of $3 million. We pay the premiums and gross up each named executive

officer’s income to pay the tax costs associated with this benefit. We also provide each named executive

officer a disability insurance benefit that provides income replacement of 60% of base salary up to a

maximum monthly benefit of $20,000. We pay the cost of this benefit and gross up such executive’s

35