Dollar General 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

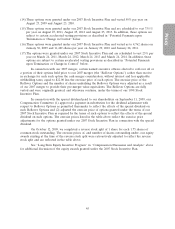

• the failure of any successor to all or substantially all of our business and/or assets to

expressly assume and agree to perform the employment agreement in the same manner and

to the same extent that our Company would be required to perform if no such succession

had taken place;

• our failure to continue any significant compensation plan or benefit without replacing it with

a similar plan or a compensation equivalent (except, in the case of all named executive

officers other than Mr. Dreiling, for across-the-board changes or terminations similarly

affecting (1) at least 95% of all of our executives or (2) 100% of officers at the same grade

level; in the case of Mr. Dreiling, for across-the-board changes or terminations similarly

affecting at least 95% of all of our executives);

• relocation of our principal executive offices outside of the middle-Tennessee area or basing

the officer anywhere other than our principal executive offices; or

• assignment of duties inconsistent, or the significant reduction of the title, powers and

functions associated, with the named executive officer’s position, all without the named

executive officer’s written consent. For all named executive officers other than Mr. Dreiling,

such acts will not constitute good reason if it results from our restructuring or realignment of

duties and responsibilities for business reasons that leaves the named executive officer at the

same rate of base salary, annual target bonus opportunity, and officer level and with similar

responsibility levels or results from the named executive officer’s failure to meet

pre-established and objective performance criteria.

No event (in the case of Mr. Dreiling, no isolated, insubstantial and inadvertent event not in

bad faith) will constitute ‘‘good reason’’ if we cure the claimed event within 30 days (10 business days

in the case of Mr. Dreiling) after receiving notice from the named executive officer.

Voluntary Termination with Good Reason or After Failure to Renew the Employment Agreement.

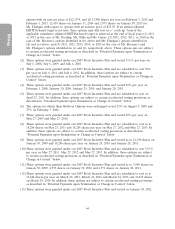

If any named executive officer resigns with good reason, all then unvested option grants held by that

officer will be forfeited. Unless we purchase any then vested options (including Rollover Options) in

total at a price equal to the fair market value of the shares underlying the vested options, less the

aggregate exercise price of the vested options, the named executive officer generally may exercise

vested options for the following periods from the termination date: 180 days in the case of options

granted to Mr. Dreiling, Mr. Tehle and Ms. Guion on or before January 21, 2008; 3 months in the case

of Rollover Options; or 90 days in the case of options granted to Messrs. Dreiling, Flanigan and

Ravener after January 21, 2008. We do not have a repurchase, or call, right with respect to the option

granted to Mr. Dreiling in April 2010 and the shares underlying such option.

In the event any named executive officer (other than Mr. Dreiling) resigns under the

circumstances described in (2) below, or in the event we fail to extend the term of Mr. Dreiling’s

employment as provided in (3) below, the relevant named executive officer’s equity will be treated as

described under ‘‘Voluntary Termination without Good Reason’’ below.

Additionally, if the named executive officer (1) resigns with good reason, or (2) in the case of

named executive officers (other than Mr. Dreiling), resigns within 60 days of our failure to offer to

renew, extend or replace the named executive officer’s employment agreement before, at or within

6 months after the end of the agreement’s term (unless we enter into a mutually acceptable severance

arrangement or the resignation is a result of the named executive officer’s voluntary retirement or

termination), or (3) in the case of Mr. Dreiling, in the event we elect not to extend the term of his

employment by providing 60 days prior written notice before the applicable extension date, then in

each case the named executive officer will receive the following benefits generally on or beginning on

the 60th day after termination of employment but contingent upon the execution and effectiveness of a

50