Dollar General 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

Our presentation of EBITDA and Adjusted EBITDA has limitations as an analytical tool, and

should not be considered in isolation or as a substitute for analysis of our results as reported under

U.S. GAAP. Because not all companies use identical calculations, these presentations of EBITDA and

Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. We

believe that the presentation of EBITDA and Adjusted EBITDA is appropriate to provide additional

information about the calculation of this financial ratio in the Credit Facilities. Adjusted EBITDA is a

material component of this ratio. Specifically, non-compliance with the senior secured indebtedness

ratio contained in our Credit Facilities could prohibit us, subject to specified exceptions, from making

investments, incurring liens, making certain restricted payments and incurring additional secured

indebtedness (other than the additional funding provided for under the senior secured credit

agreement).

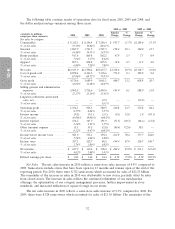

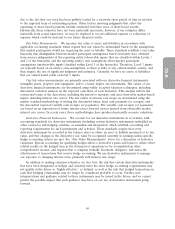

The calculation of Adjusted EBITDA under the Credit Facilities is as follows:

Year Ended

January 28, January 29,

2011 2010

(in millions)

Net income .................................... $ 627.9 $ 339.4

Add (subtract):

Interest income ................................ (0.2) (0.1)

Interest expense ............................... 274.1 345.6

Depreciation and amortization ..................... 242.3 241.7

Income taxes .................................. 357.1 212.7

EBITDA ...................................... 1,501.2 1,139.3

Adjustments:

Loss on debt retirements ......................... 14.6 55.3

Loss on hedging instruments ...................... 0.4 0.5

Impact of markdowns related to inventory clearance

activities, net of purchase accounting adjustments ..... — (7.3)

Advisory and consulting fees to affiliates .............. 0.1 63.5

Non-cash expense for share-based awards ............. 16.0 18.7

Indirect merger-related costs ...................... 1.3 10.6

Other non-cash charges (including LIFO) ............. 11.5 6.6

Total Adjustments ................................ 43.9 147.9

Adjusted EBITDA ............................... $1,545.1 $1,287.2

Interest Rate Swaps

We use interest rate swaps to minimize the risk of adverse changes in interest rates. These swaps

are intended to reduce risk by hedging an underlying economic exposure. Because of high correlation

between the derivative financial instrument and the underlying exposure being hedged, fluctuations in

the value of the financial instruments are generally offset by reciprocal changes in the value of the

underlying economic exposure. Our principal interest rate exposure relates to outstanding amounts

under our Credit Facilities. At January 28, 2011, we had interest rate swaps with a total notional

amount of approximately $1.05 billion. For more information see Item 7A ‘‘Quantitative and

Qualitative Disclosures about Market Risk’’ below.

40