Dollar General 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

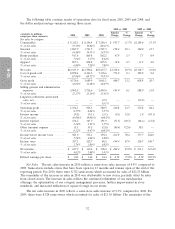

For the year ended January 28, 2011, our continued focus on our four priorities resulted in

improved financial performance over the year ended January 29, 2010 in each of our key financial

metrics, as follows. Basis points, as referred to below, are equal to 0.01 percent of total sales.

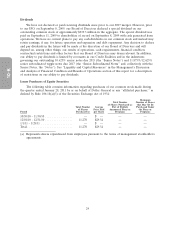

• Total sales in fiscal 2010 increased 10.5 percent over 2009. Sales in same-stores increased

4.9 percent, following a strong 9.5 percent increase in 2009. Customer traffic and average

transaction amount increased in both 2010 and 2009. Average sales per square foot in 2010 were

$201, up from $195 in 2009.

• Gross profit, as a percentage of sales, was 32.0 percent in 2010, an increase of 76 basis points

over 2009. This improvement was primarily attributable to increased purchase markups, net of

increased markdowns, resulting from increased volume, which enabled us to lower our average

costs from vendors. The improvement also reflected the continued impact of our comprehensive

category management enhancements.

• SG&A, as a percentage of sales, for fiscal 2010 was 22.3 percent compared to 23.2 percent in

2009. SG&A in 2009 included incremental expenses of $68.3 million, or 58 basis points, resulting

from the termination of our sponsor advisory agreement and the accelerated vesting of certain

equity-based compensation related to our initial public offering. SG&A in 2010 included

incremental expenses of $19.7 million, or 15 basis points, resulting from costs related to two

secondary offerings of our common stock during the year by certain of our shareholders.

Excluding the impact of these costs, SG&A, as a percentage of sales declined primarily due to

lower employee incentive compensation, which is based on financial targets set at the beginning

of each fiscal year (our results exceeded those targets in 2010 but not to the same degree as in

2009), lower healthcare expense, and the impact of other cost reduction and productivity

initiatives which resulted in various expenses decreasing or increasing at a rate lower than the

10.5 percent increase in sales.

• Interest expense decreased by $71.5 million in 2010 to $274.2 million, primarily as the result of

lower average outstanding long-term obligations. Net proceeds from our initial public offering

and excess cash were utilized in our fiscal 2009 fourth quarter to voluntarily reduce long-term

obligations by $725.9 million, and in 2010 we repurchased an additional $115.0 million of

long-term obligations utilizing operating cash flow. Other non-operating expenses include

charges totaling $14.7 million in 2010 and $55.3 million in 2009 resulting from these repurchases.

• We reported net income of $627.9 million, or $1.82 per diluted share, for fiscal 2010, compared

to net income of $339.4 million, or $1.04 per diluted share, in 2009. Charges relating to

secondary stock offerings by certain of our shareholders, including the acceleration of certain

equity appreciation rights, and losses from the repurchase of long-term obligations, reduced 2010

net income by $21.3 million, or $0.06 per diluted share. In 2009, charges resulting from the

termination of our sponsor advisory agreement, the acceleration of certain equity-based

compensation and the repurchase of long-term obligations, related to or resulting from our

initial public offering, reduced net income by $82.9 million, or $0.26 per diluted share.

• We generated approximately $825 million of cash flows from operating activities in 2010, an

increase of over 22 percent compared to 2009. Cash flow was primarily utilized to support our

capital expenditures and repurchase long-term obligations.

• During 2010, we opened 600 new stores, remodeled or relocated 504 stores, and closed 56

stores, resulting in a store count of 9,372 on January 28, 2011.

As discussed in more detail below, in recent years, we have generated significant cash flows from

operating activities. We have used a portion of these cash flows to pay down debt and to invest in new

store growth through our traditional leased stores. During 2010 we made a strategic decision to

purchase certain of our leased stores. We believe that the current environment in the real estate

29