Dollar General 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

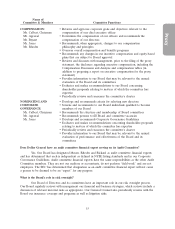

Proxy

appropriate return on our invested capital and (2) the management and level of investments

necessary to achieve superior business performance.

• We achieved adjusted EBITDA and ROIC performance levels at 105.5% and 100.9% of the

targeted levels under our Teamshare bonus program.

• The 2010 tranche of the outstanding performance-based equity awards vested as a result of

our achievement of the adjusted EBITDA performance goal.

Our Compensation Committee will continue to evaluate our executive compensation program

and make changes when it believes it to be appropriate and in the best interests of our shareholders.

Executive Compensation Philosophy and Objectives

We strive to attract, retain and motivate persons with superior ability, to reward outstanding

performance, and to align the interests of our named executive officers with the long-term interests of

our shareholders. The material compensation principles applicable to the 2010 and 2011 compensation

of our named executive officers included the following, all of which are discussed in more detail in

‘‘Elements of Named Executive Officer Compensation’’ below:

• We generally target total compensation at the benchmarked median of our market

comparator group, but we make adjustments based on circumstances, such as unique job

descriptions and responsibilities as well as our particular niche in the retail sector, that are

not reflected in the market data. For competitive or other reasons, our levels of total

compensation or any component of compensation may exceed or be below the median of our

comparator group.

• We set base salaries to reflect the responsibilities, experience, performance and contributions

of the named executive officers and the salaries for comparable benchmarked positions,

subject to minimums set forth in employment agreements.

• We reward named executive officers who enhance our performance by linking cash and

equity incentives to the achievement of our financial goals.

• We promote share ownership to align the interests of our named executive officers with

those of our shareholders.

The Compensation Committee utilizes employment agreements with the named executive

officers which, among other things, set forth minimum levels of certain compensation components. The

Committee believes such arrangements are a common protection offered to named executive officers at

other companies and help to ensure continuity and aid in retention. The employment agreements also

provide for standard protections to both the executive and to Dollar General should the executive’s

employment terminate. In 2010, after achieving tremendous financial results, we entered into an

amended and restated employment agreement with Mr. Dreiling, described under ‘‘Compensation of

Mr. Dreiling’’ below.

Named Executive Officer Compensation Process

Oversight. The Compensation Committee of our Board of Directors approves the

compensation of our named executive officers, while its subcommittee consisting entirely of

independent directors (the ‘‘162(m) Subcommittee’’) approves any portion that is intended to qualify as

‘‘performance-based compensation’’ under Section 162(m) of the Internal Revenue Code or that is

intended to be exempt for purposes of Section 16(b) of the Securities Exchange Act of 1934.

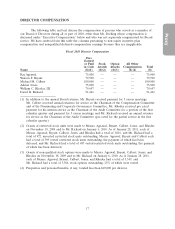

Messrs. Calbert, Agrawal, Jones, Rhodes, and Bryant serve on our Compensation Committee, and

Messrs. Rhodes and Bryant make up the 162(m) Subcommittee.

25