Dollar General 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy

Mr. Dreiling’s 2010 annual base salary increase was negotiated in connection with the renewal

of his employment agreement. The 2.5% salary increase was effective April 1, 2010, and was settled

upon after considering Mr. Dreiling’s performance assessment and our annual base salary budget for all

U.S.-based employees. However, because the benchmarking data indicated that Mr. Dreiling’s total

cash compensation was below the median of the market comparator group, the Committee increased

his Teamshare bonus target for fiscal 2010 as discussed under ‘‘Short-Term Cash Incentive Plan’’ below.

To determine Mr. Dreiling’s annual base salary increase for 2011, the Committee took into

account Mr. Dreiling’s performance assessment, the amount budgeted for our entire U.S.-based

employee population (see ‘‘Use of Performance Evaluations’’ above), and the benchmarking data of the

market comparator group (see ‘‘Use of Market Benchmarking Data’’ above). Such benchmarking data

indicated that Mr. Dreiling’s total cash compensation was below the median of the market comparator

group. Accordingly, the Committee approved a 5% annual base salary increase effective as of April 1,

2011, which consists of the budgeted 2.5% increase and the additional 2.5% market adjustment

intended to more closely align Mr. Dreiling’s total cash compensation with the median of the market

comparator group. Mr. Dreiling’s target bonus percentage for the 2011 short-term cash incentive plan

was also increased as discussed further below.

Short-Term Cash Incentive Plan. Our short-term cash incentive plan, called Teamshare,

motivates named executive officers to achieve pre-established, objective, annual financial goals.

Teamshare provides an opportunity for each named executive officer to receive a cash bonus payment

equal to a certain percentage of base salary based upon Dollar General’s achievement of one or more

pre-established financial performance measures. For our named executive officers, the Teamshare

program is established pursuant to our Annual Incentive Plan, under which ‘‘covered employees’’ under

Section 162(m) of the Internal Revenue Code, any of our executive officers, and such other of our

employees as the Committee may select (including our named executive officers), may earn up to

$5 million (up to $2.5 million prior to 2010) in respect of a given fiscal year, subject to the achievement

of certain performance targets based on any of the following performance measures: net earnings or

net income (before or after taxes), earnings per share, net sales or revenue growth, gross or net

operating profit, return measures (including, but not limited to, return on assets, capital, invested

capital, equity, sales, or revenue), cash flow (including, but not limited to, operating cash flow, free

cash flow, and cash flow return on capital), earnings before or after taxes, interest, depreciation, and/or

amortization, gross or operating margins, productivity ratios, share price (including, but not limited to,

growth measures and total shareholder return), expense targets, margins, operating efficiency, customer

satisfaction, working capital targets, economic value added, volume, capital expenditures, market share,

costs, regulatory ratings, asset quality, net worth, or safety. The Committee administers the Annual

Incentive Plan and can amend or terminate it at any time.

As a threshold matter, a named executive officer’s eligibility to receive a bonus under the

Teamshare program depends upon his or her receiving an overall subjective individual performance

rating of satisfactory (see ‘‘Use of Performance Evaluations’’ above). Accordingly, Teamshare fulfills an

important part of our pay for performance philosophy while aligning the interests of our named

executive officers and our shareholders. Teamshare also helps us meet our recruiting and retention

objectives by providing compensation opportunities that are consistent with those prevalent in our

market comparator group.

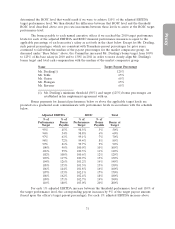

(a) 2010 Teamshare Structure. The Committee selected adjusted EBITDA, as calculated

below, for the primary financial performance measure and added return on invested capital (‘‘ROIC’’),

calculated as set forth below, as an additional financial performance measure for officer-level

employees to reflect the importance of achieving an appropriate return on our invested capital and the

management of and level of investments necessary to achieve superior business performance. The

Committee weighted the ROIC measure at 10% and the adjusted EBITDA measure at 90% of the

29